Introduction:

As a trade facilitation measure and in order to further ease the process of doing business, the GST Council in its 42nd meeting held on 05.10.2020 has recommended for quarterly return filing facility for small taxpayers. Based on these recommendations, Government has introduced the scheme of Quarterly Return filing with Monthly Payment of taxes (for brevity ‘QRMP scheme’). This scheme has been introduced to minimize the burden of compliances on small taxpayers having aggregate turnover of up to INR 5 crores. This new Scheme will be effective from 01.01.2021.

Applicability:

A registered person who is required to furnish a return in Form GSTR-3B, and who has an aggregate turnover of up to INR 5 crore rupees in the preceding financial year, is eligible to opt for the QRMP Scheme in the current financial year. However, in case the aggregate turnover exceeds INR 5 crores during any quarter in the current financial year, the registered person shall not be eligible for the scheme from the next quarter.

The aggregate annual turnover for the preceding financial year shall be calculated in the common portal from the details furnished in the returns of the preceding financial year. The above provisions can be well understood with the help of following examples:

|

· Registered person having aggregate turnover up to INR 5 crore in the preceding FY is eligible for QRMP scheme.

· If aggregate turnover exceeds INR 5 crore in any quarter during the current FY, QRMP scheme will not be available from next quarter. Aggregate Turnover shall be computed on common portal.

· Fresh registrants and persons switching from composition scheme to regular scheme can also avail this scheme.

· QRMP scheme can be availed GSTIN wise and taxpayer can opt for this option for few GSTINs and can go with monthly filing for others. |

Example 1:

M/s. ABC Private limited has aggregate turnover of Rs. 4.5 crores for the Financial Year (FY) 2020-21, then for the FY 2021-22 they shall be eligible for QRMP scheme.

Now in FY 2021-22, up to 2nd quarter (i.e., till September 2021) aggregate turnover of M/s. ABC Private Limited was Rs. 5.6 crores. So, from the 3rd quarter (i.e., from October 2021) onwards, they will not be eligible for QRMP scheme.

Example 2:

Suppose in the above example, in the FY 2021-22 up to July 2021 (1st month of 2nd quarter) the turnover was Rs. 5.6 crores, then QRMP scheme shall be available for the balance 2 months (i.e., August and September 2021) and it will not be available from 3rd quarter (i.e., from October 2021) onwards.

All persons who have obtained fresh registration during the current FY, or any registered person who is opting out from composition scheme to regular scheme will also be eligible to avail the benefit of QRMP scheme. The option to avail the QRMP scheme is GSTIN wise and therefore, distinct persons as defined in Section 25 of the CGST Act (different GSTINs on same PAN) have the option to avail the QRMP Scheme for one or more GSTINs. In other words, some GSTINs for that PAN can opt for the QRMP Scheme and remaining GSTINs may not opt for the Scheme.

Time Limit and Conditions for Switching to and Opting Out of the Scheme:

|

· QRMP scheme for any quarter can be opted for at any time for first day of second month of preceding quarter to last day of the first month of said quarter.

· The option to opt out of the scheme for any quarter shall also be exercised with the above referred time limit.

· For Jan 21 to Mar 21 being first quarter, the GST portal migrate the tax payer to QRMP/Monthly filing based on their anticipated behavior. However, such taxpayer can be free to chose or opt out of QRMP scheme at any time from 5.12.2020 to 31.01.2021. |

The Scheme can be availed on the common portal throughout the year at the option of the registered person. The QRMP scheme is optional and not mandatory. As per Rule 61A of the CT Rules[1], a registered person can opt for the scheme for any quarter from first day of second month of preceding quarter to the last day of the first month of the said quarter. In order to exercise this option, the registered person must have furnished the last return, as due on the date of exercising such option.

For example: A registered person intending to avail of the Scheme for the quarter 'July to September' can exercise his option during 1st of May to 31st of July. If he is exercising his option on 27th July for the quarter (July to September), in such case, he must have furnished the return for the month of June which was due on 22/24th July.

Time limit for availing the QRMP scheme for the FY 2021-22:

|

Quarter |

Period |

Time Limit |

|

1st |

April 2021 to June 2021 |

1st February 2021 to 30th April 2021 |

|

2nd |

July 2021 to September 2021 |

1st May 2021 to 31st July 2021 |

|

3rd |

October 2021 to December 2021 |

1st August 2021 to 31st October 2021 |

|

4th |

January 2022 to March 2022 |

1st November 2021 to 31st January 2022 |

Registered persons are not required to exercise the option every quarter. Where such option has been exercised once, they shall continue to furnish the return as per the selected option for future quarters, unless they revise the said option. Similarly, the facility for opting out of the Scheme for a quarter will be available from first day of second month of preceding quarter to the last day of the first month of the quarter.

In case the aggregate turnover exceeds INR 5 crores during any quarter in the current financial year, the registered person shall not be eligible for the Scheme from the next quarter and shall furnish returns on monthly basis for the said next quarter.

|

· GSTR-1 and GSTR-3B shall be filed on quarterly basis.

· For each of the first two months of the quarter, IFF will be available to upload invoices from 1st to 13th of the succeeding month.

· Details of such outward supplies in IFF shall not exceed Rs.50 lakhs per month. IFF is an optional facility.

· Only such details which are not furnished in IFF shall be provided in GSTR-1 of the quarter.

· Amount deposited in first two months shall be first utilised towards offsetting the liability of the relevant quarter. Balance left, if any, can be claimed as refund or can be settled in future quarters. |

For the 1st quarter of the Scheme (i.e., for the quarter January 2021 to March 2021), in order to facilitate the taxpayers, it has been decided that all the registered persons, whose aggregate turnover for the FY 2019-20 is up to INR 5 crore and who have furnished the return in Form GSTR-3B for the month of October 2020 by 30th November 2020, shall be migrated on the common portal as below:

|

Sl.No. |

Eligible Class of Registered Person for QRMP Scheme |

Default Option |

|

1 |

Registered persons having aggregate turnover of up to 1.5 crore rupees who have furnished FORM GSTR-1 on quarterly basis in the current financial year |

Quarterly Return |

|

2 |

Registered persons having aggregate turnover of up to 1.5 crore rupees who have furnished FORM GSTR-1 on monthly basis in the current financial year |

Monthly Return |

|

3 |

Registered persons having aggregate turnover more than 1.5 crore rupees and up to 5 crore rupees in the preceding financial year |

Quarterly Return |

The taxpayers who have not filed their return for October 2020 on or before 30th November 2020 will not be migrated to the Scheme. They will be able to opt for the Scheme once the Form GSTR-3B as due on the date of exercising option has been filed. Above default option has been provided for the convenience of registered persons based on their anticipated behaviour. However, such registered persons are free to change the option as above from 5th December 2020 to 31st January 2021.

Furnishing of Returns:

As per Rule 59 of the CT Rules, the registered persons opting for the Scheme would be required to furnish the details of outward supply in Form GSTR-1 on quarterly basis. For each of the first and second months of a quarter, a registered person will have the facility called Invoice Furnishing Facility (IFF) to furnish the details of outward supplies, as he may consider necessary, between the 1st day of the succeeding month till the 13th day of the succeeding month. It may be noted that after 13th of the month, the IFF for previous month would not be available. A taxpayer can continuously upload the invoices from 1st to 13th of the month.

However, details of such outward supplies shall not exceed INR 50 lakhs in each month. Therefore, the tax payer opting for QRMP scheme are required to choose and upload the details of those outward supplies for which recipients are interested in availing input tax credit. The facility of furnishing details of invoices in IFF has been provided so as to allow details of such supplies to be duly reflected in the Form GSTR-2A and Form GSTR-2B of the concerned recipient.

IFF is not mandatory and is only an optional facility made available to the registered persons under the QRMP Scheme. The details of invoices furnished using the said facility in the first two months are not required to be furnished again in Form GSTR-1. Accordingly, only the details of outward supplies which are not furnished through IFF for each of the 1st and 2nd months of the quarter shall be furnished in Form GSTR-1 of the quarter.

Such registered persons would be required to furnish Form GSTR-3B, for each quarter, on or before 22nd or 24th day of the month succeeding such quarter. In Form GSTR-3B, they shall declare the supplies made during the quarter, ITC availed during the quarter and all other details required to be furnished therein.

The amount deposited by the registered person in the first two months shall be debited solely for the purposes of offsetting the liability furnished in that quarter's Form GSTR-3B. However, any amount left after filing of that quarter's Form GSTR-3B may either be claimed as refund or may be used for any other purpose in subsequent quarters. In case of cancellation of registration of such person during any of the first two months of the quarter, he is still required to furnish return in Form GSTR-3B for the relevant quarter.

Monthly Payment of Tax:

The registered person under the QRMP Scheme would be required to pay the tax due in each of the first two months of the quarter by depositing the due amount in FORM GST PMT-06. Such amount shall be deposited by 25th of the month succeeding each such month. For example, Tax due for the month of April 2021 shall be paid by 25th May and tax due for the month of May 2021 shall be paid by 25th June.

While generating the challan, taxpayers should select "Monthly payment for quarterly taxpayer" as reason for generating the challan. The said person can use any of the following two options provided below for monthly payment of tax during the first two months —

- Fixed Sum Method, and

- Self-Assessment Method.

Fixed Sum Method:

A facility is being made available on the portal for generating a pre-filled challan in Form GST PMT-06 for an amount equal to 35% of the tax paid in cash in the preceding quarter where the return was furnished quarterly; or equal to 100% of the tax paid in cash in the last month of the immediately preceding quarter where the return was furnished monthly. For easy understanding, the same is explained by way of illustration in table below:

Case 1: Last Return for the Quarter ending March 2021 was filed on quarterly basis:

|

Tax Paid in Cash in Quarter (January to March 2021) |

Tax Required to be paid in each of the Months – April and May 2021 |

||

|

CGST |

100 |

CGST |

35 |

|

SGST |

100 |

SGST |

35 |

|

IGST |

500 |

IGST |

175 |

|

Cess |

50 |

Cess |

17.5 |

Case 2: Last return for the month ending March 2021 was filed on monthly basis:

|

Tax Paid in Cash in March 2021 |

Tax Required to be paid in each of the Months – April and May 2021 |

||

|

CGST |

50 |

CGST |

50 |

|

SGST |

50 |

SGST |

50 |

|

IGST |

80 |

IGST |

80 |

|

Cess |

- |

Cess |

- |

Monthly tax payment through this method would not be available to those registered persons who have not furnished the return for a complete tax period preceding such month. A complete tax period means a tax period in which the person is registered from the first day of the tax period till the last day of the tax period

Self-Assessment Method:

The registered person can pay the tax due by considering the tax liability on inward and outward supplies and the input tax credit available, in FORM GST PMT-06. ITC available for the month can be ascertained from the ITC reflecting in FORM GSTR-2B. The registered person is free to avail either of the two tax payment methods as stated above in any of the first two months of the quarter.

|

· The tax due for each of the first two months of the quarter shall be paid in FORM GST PMT – 06 by 25th of the succeeding month of each such month.

· The said amount can be paid by following fixed sum method or self-assessment method at the option of the registered person.

· If adequate balance is available in E-Cash/E-Credit Ledgers for the tax due for the 1st & 2nd month of the quarter or if there is Nil Liability, then the registered person need not pay any tax.

· Any claim of refund shall be permitted only after filing of GSTR 3B. |

In case the balance in the electronic cash ledger and/or electronic credit ledger is adequate for the tax due for the first month of the quarter or where there is nil tax liability, the registered person may not deposit any amount for the said month.

Similarly, for the second month of the quarter, in case the balance in the electronic cash ledger and/or electronic credit ledger is adequate for the cumulative tax due for the first and the second month of the quarter or where there is nil tax liability, the registered person may not deposit any amount.

Any claim of refund in respect of the amount deposited for the first two months of a quarter for payment of tax shall be permitted only after the return in FORM GSTR-3B for the said quarter has been furnished. Further, this deposit cannot be used by the taxpayer for any other purpose till the filing of return for the quarter.

Applicability of Interest:

- For registered persons making payment of tax by opting Fixed Sum Method:

No interest would be payable in case the tax due is paid in the first two months of the quarter by way of depositing auto-calculated fixed sum amount by the due date. In other words, if while furnishing return in Form GSTR-3B, it is found that in any or both of the first two months of the quarter, the tax liability net of ITC on the supplies made/received was higher than the amount paid in challan, then, no interest would be charged provided they deposit system calculated amount for each of the first two months and discharge their entire liability for the quarter in the Form GSTR-3B of the quarter by the due date.

In case such payment of tax by depositing the system calculated amount in Form GST PMT-06 is not done by due date, interest would be payable at the rate of 18%, from the due date of furnishing Form GST PMT-06 till the date of making such payment. Further, in case Form GSTR-3B for the quarter is furnished beyond the due date, interest would be payable at the rate of 18% for the tax liability net of input tax credit.

It can be further explained with the help of the following Illustrations:

Illustration 1 -

A registered person, who has opted for the Scheme, had paid a total amount of Rs. 100/- in cash as tax liability in the previous quarter of October to December. He opts to pay tax under fixed sum method. He therefore pays Rs. 35/- each on 25th February and 25th March for discharging tax liability for the first two months of quarter viz. January and February. In his return for the quarter, it is found that liability, based on the outward and inward supplies, for January was Rs. 40/- and for February it was Rs. 42/-. No interest would be payable for the lesser amount of tax (i.e. Rs. 5 and Rs. 7 respectively) discharged in these two months provided that he discharges his entire liability for the quarter in the FORM GSTR-3B of the quarter by the due date.

Illustration 2 -

A registered person, who has opted for the Scheme, had paid a total amount of Rs. 100/- in cash as tax liability in the previous quarter of October to December. He opts to pay tax under fixed sum method. He therefore pays Rs. 35/- each on 25th February and 25th March for discharging tax liability for the first two months of quarter viz. January and February. In his return for the quarter, it is found that total liability for the quarter net of available credit was Rs. 125 but he files the return on 30th April. Interest would be payable at applicable rate on Rs. 55 [Rs. 125 - Rs. 70 (deposit made in cash ledger in M1 and M2)] for the period between due date of quarterly GSTR 3B and 30th April.

For registered person making payment of tax by opting Self-Assessment Method:

As per Section 50 of the CGST Act, interest would be payable at the rate of 18% on the tax or any part amount thereof (net of ITC) which remains unpaid/paid beyond the due date for the first two months of the quarter. Interest shall be paid through FORM GSTR-3B. It is clarified that in case taxpayers opted for QRMP scheme late fee is applicable for delay in filing GSTR-1 and GSTR-3B returns due for the quarter and no such late fee is applicable for delay in deposit of tax for first and second months of the quarter.

Drawback of QRMP scheme:

QRMP scheme aims at minimizing the number of returns to be filed by small taxpayers in order to reduce the compliance burden on them. Technically, the scheme lowers the number of returns to be filed but one may doubt whether it has actually reduced the compliance burden on such small taxpayers. The reason for this that they are still required to pay the tax on monthly basis. Considering the business needs, when a small taxpayer opt for self-assessment method, he is required to carry out all the processes required for filing GSTR-3B return viz. determining outwards sales, gross tax liability, available input tax and the net tax payable in cash. This implies that he is only relieved from actual filing of GSTR-3B return but he is required to make himself prepared for filing the said return by determining his tax liability.

On the other hand, though taxpayer is relieved from filing monthly GSTR-1 returns, he is required to invoice details in IFF. This is more or less akin to filing GSTR-1 return on a monthly basis. Though uploading of invoices through IFF is optional but as the same is required to enable the recipient to avail input tax credit, taxpayers may not practically consider this as optional.

Conclusion:

Considering the limitations pointed above, QRMP scheme is a welcoming move that will provide flexibility and lessen the compliance burden for small taxpayers. Small taxpayers who are supplying their goods or services majorly to end consumers can benefit out of the scheme and it will certainly lower their compliance burden. Further, as it comes with IFF facility, it allows many small taxpayers who were hitherto forced to file their GSTR-1 returns on monthly basis in order to pass the input tax credit to their recipients to move to quarterly filing facility without any compromise on passing of input tax credit. The option of paying fixed amounts as tax for first two months of a quarter based on previous quarter tax liability without any interest burden also encourages many taxpayers to opt for this scheme. Let us all hope that Government will revive the scheme time and again to make it further attractive and lower the compliance burden.

Step-by-Step Procedures to opt for the scheme and furnish invoice details in IFF Facility:

- Step-by-Step Procedure to convert from the existing regular filing of returns to QRMP Scheme:

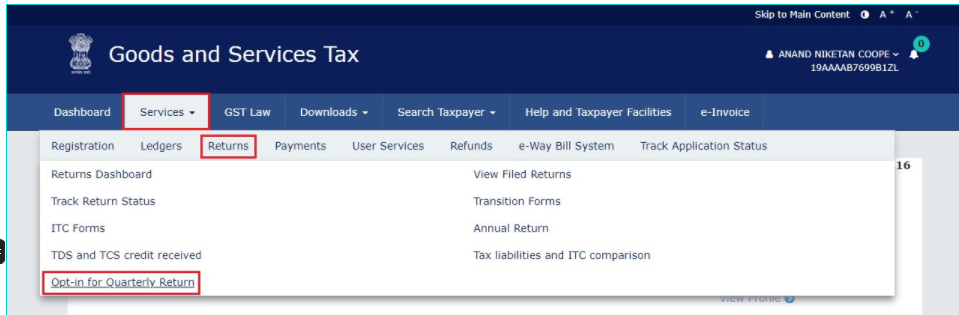

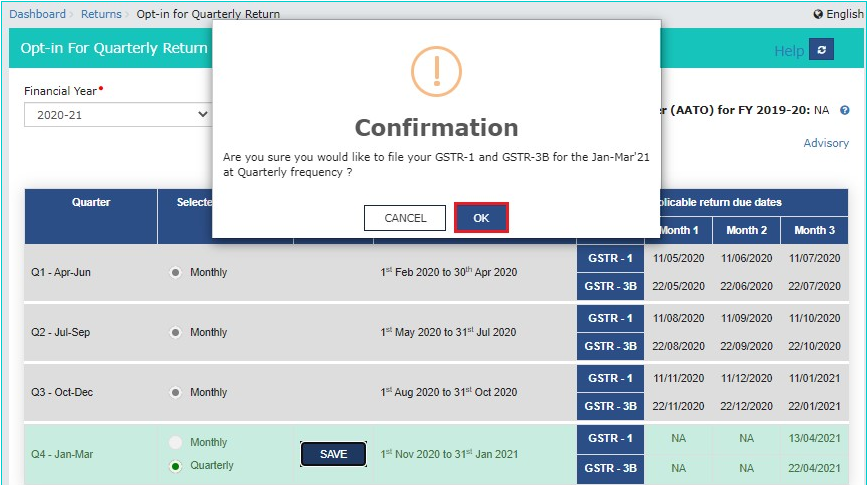

Step 1: Login to the GST Portal with valid credentials. Click the Services > Returns > Opt-in for Quarterly Return option. The same is depicted below:

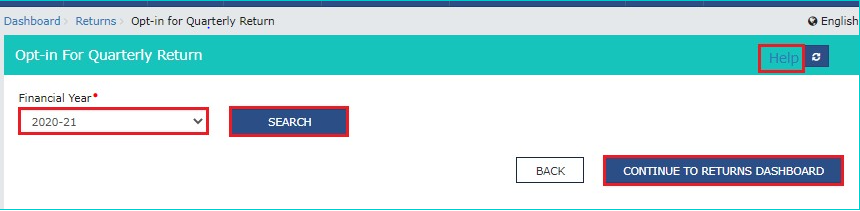

Step 2: The Opt-in for Quarterly Return page is displayed. From the Financial Year drop-down list select the year for which you want to change the filing frequency and click the SEARCH button. The same is depicted below:

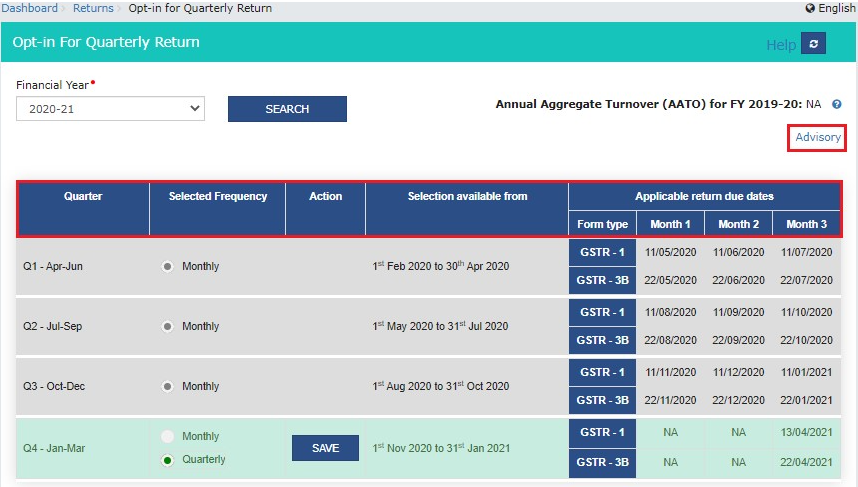

Step 3: The following details are displayed on the screen.

- Quarter: Lists the four quarters of the selected financial year.

- Selected Frequency:Displays the option of Monthly and Quarterly that can be selected for the quarter. The Quarter which is open for selection is highlighted in green with SAVE button and the quarters which are not available for selection is highlighted in grey. For FY 2020-21 only one quarter will be open for selection and the remaining quarters will not be open.

- Action: Displays the SAVEbutton against the quarter for which the selection is applicable.

- Selection available from: Displays specific dates of the quarter during which the selection is made available from.

- Applicable return due dates for Form GSTR-1 and Form GSTR-3B forms: Displays the return due dates applicable for month 1, month 2 and month 3 of a quarter.

The above discussion is depicted below:

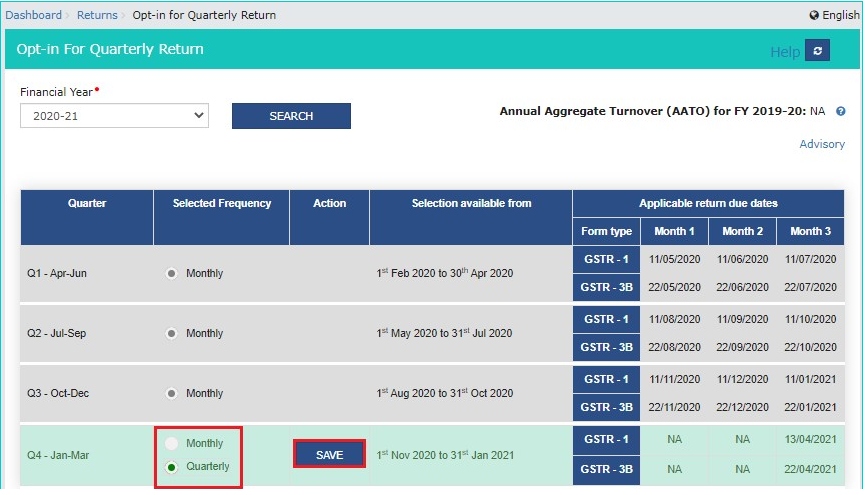

Step 4: To change the filing frequency to Monthly or Quarterly, select the radio button corresponding to the quarter and click the SAVE button, to save the preference. The same is depicted below:

Step 5: A confirmation message is displayed on the screen. Click the OK button. Below screenshot is displayed when the taxpayer selects the filing frequency as Quarterly.

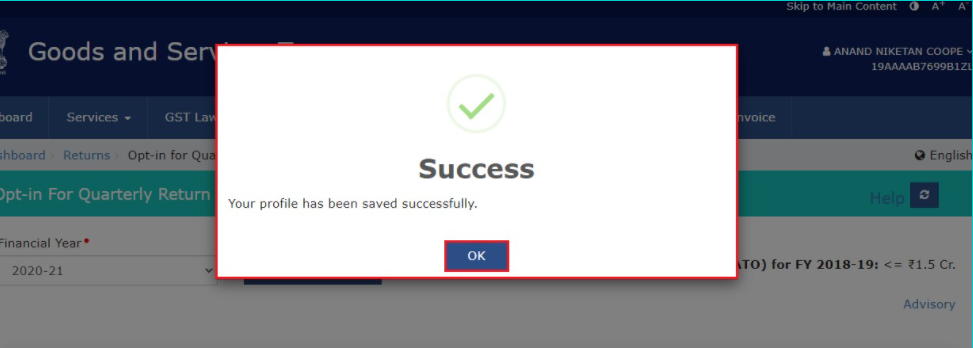

Step 6: A success message is displayed that confirms successful change of profile to the selected filing frequency. Click the OK button.

Step 7: Clicking the OK button displays the Opt-in for Quarterly Return page. The screen displays, the filing frequency has been set and the SAVE button is disabled.

Note: Once the Taxpayer opts in or opts out of the QRMP scheme, an Email and SMS is sent to the Primary Authorized Signatory of the taxpayer.

- Step-by-Step Procedure for furnishing Documents in Invoice Furnishing Facility (IFF) under QRMP Scheme:

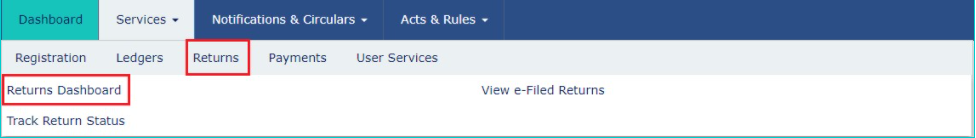

Step 1: Login to the GST Portal with valid credentials i.e. your user id and password. Click the Services > Returns > Returns Dashboard command. The same is depicted below:

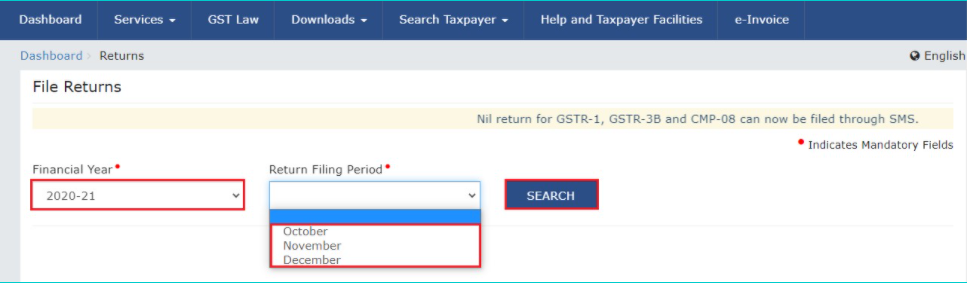

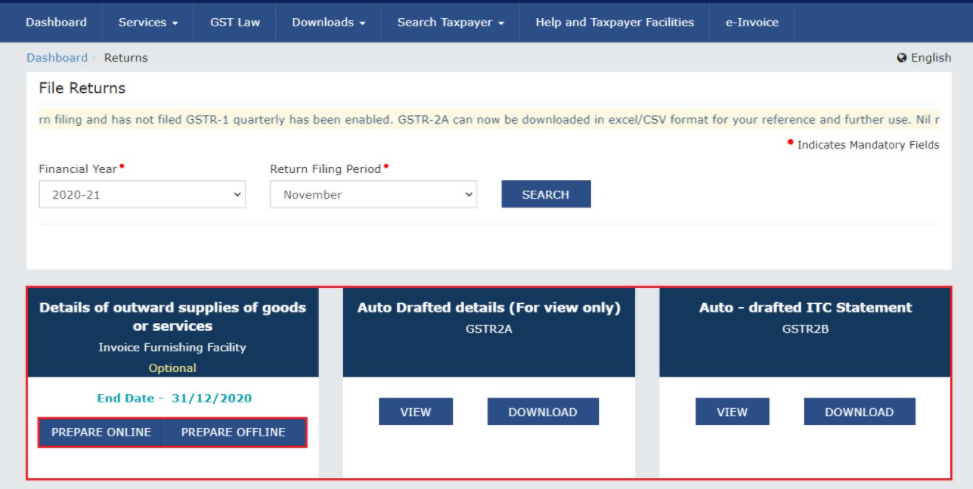

Step 2: The File Returns page is displayed. Select the Financial Year & Return Filing Period (Month1 of a quarter) for which you want to file the return from the drop-down list and click the SEARCH button. The same is depicted below:

Step 3: In the Invoice Furnishing Facility tile, click the PREPARE ONLINE button if you want to prepare the return by making entries on the GST Portal. Alternatively, you can click the PREPARE OFFLINE button to upload the JSON file containing details of outward supplies through the Returns Offline Tool. The same is depicted below:

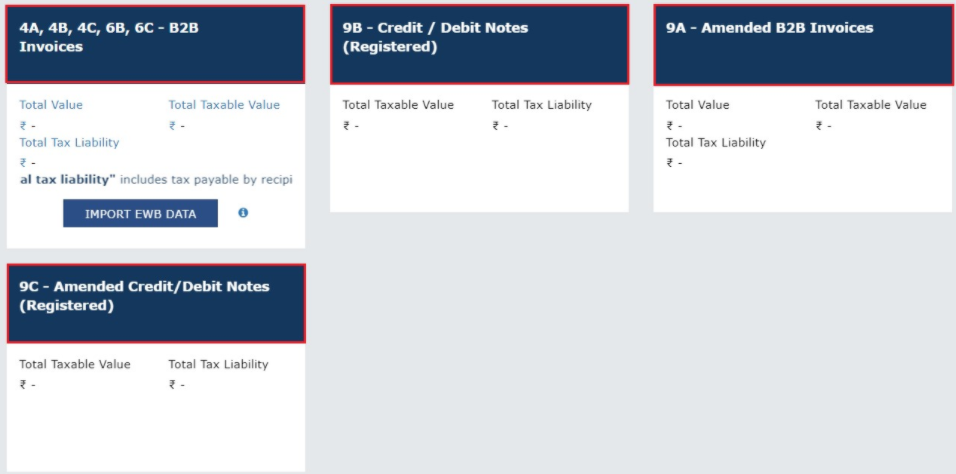

Step 4: The IFF – Invoice Details page is displayed. As a part of IFF, the following tables are displayed.

- Table 4A,4B,4C,6B,6C – B2B Invoices shall be used to add an invoice for taxable outwards supplies to a registered person.

- Table 9A – Amended B2B Invoice shall be used to make amendments to details of outward supplies to a registered person of earlier tax periods.

- Table 9B – Credit/Debit Notes shall be used to add details of credit or debit notes issued to the registered recipients.

- Table 9C – Amended Credit/Debi Notes (Registered) shall be used to make amendments to details of credit or debit notes issued to the registered recipients of earlier tax periods.

Step 5: Procedure to add invoices for taxable outward supplies to a registered person in Table 4A,4B,4C,6B,6C – B2B Invoices

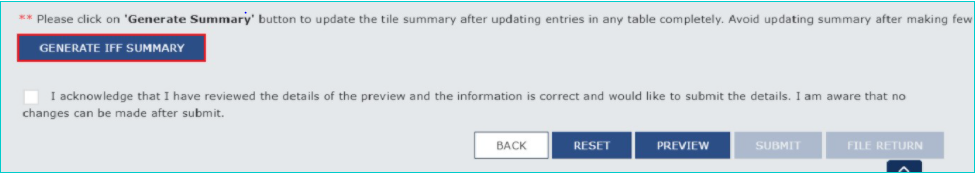

- Step (a): Click the 4A, 4B, 4C, 6B, 6C - B2B Invoicestile to enter the invoice details for B2B transactions (goods/ services sold to a registered taxpayer). You can import the data from e-Way Bill (EWB) System by clicking on the IMPORT EWB DATA As depicted in the above image.

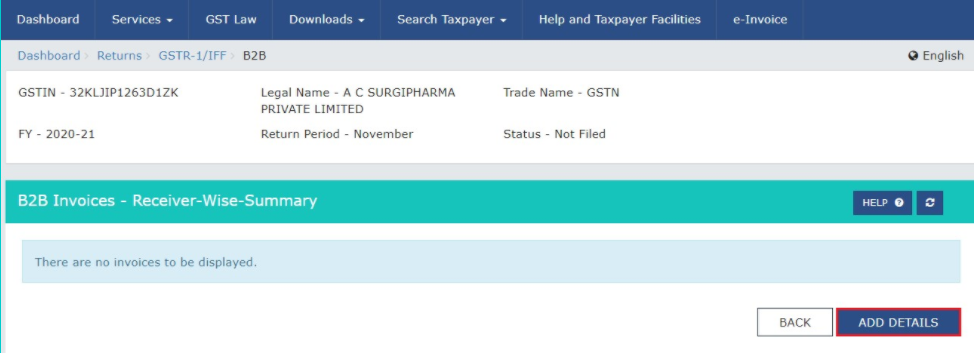

- Step (b): The B2B Invoices – Receiver-Wise-Summarypage is displayed. Click the ADD DETAILS button to add a new invoice for any receiver. The same is depicted below:

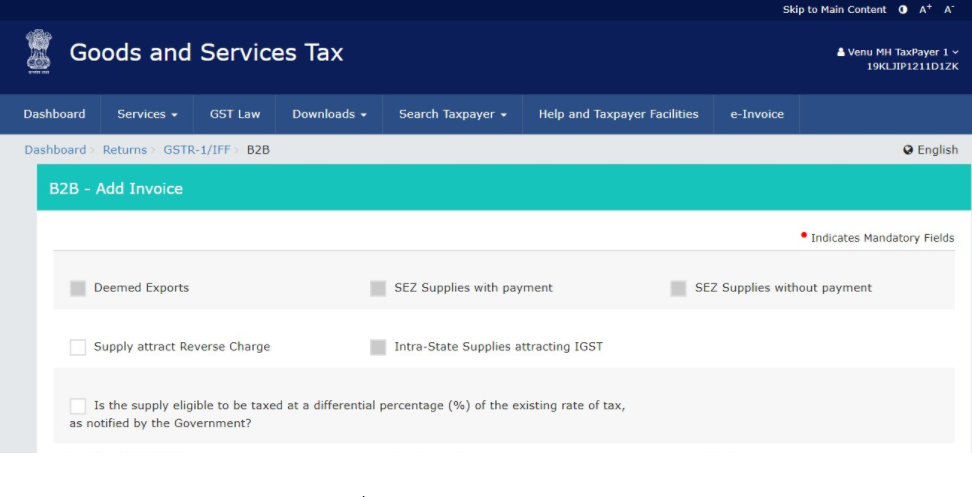

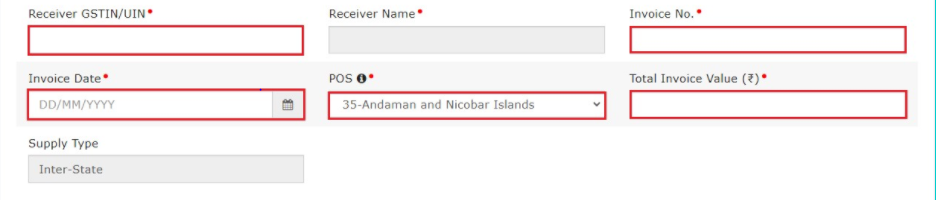

- Step (c): The B2B – Add Invoice page is displayed. In the Receiver GSTIN/UIN field, enter the GSTIN or UIN of the receiver.

- Step (d): Select the checkbox for Deemed Exports or SEZ Supplies with payment or SEZ supplies without payment, Supply attract Reverse Charge, Inter-State Supplies attracting IGST, as applicable.

Note: Deemed export details can be provided for payment of IGST, CGST and SGST payments.

- Step (e): In theInvoice No., Invoice Date and Total Invoice Value fields, enter the Invoice number, date of the invoice and value of the total invoice.

- Step (f): Select the Supply attract Reverse Chargecheckbox, in case supply made to the taxpayer is covered under the reverse charge mechanism.

- Step (g): Select the checkbox provided Is the supply eligible to be taxed at a differential percentage (%) of the existing rate of tax, as notified by the Government?, in case supply is eligible to be taxed at a differential percentage of the existing rate of tax.

- Step (h): Fill all the details as required in the appropriate fields. Click the SAVEbutton to save the invoice details.

The above steps from Step (c) to Step (h) are depicted below:

- Step (i): You will be directed to the previous page and a message is displayed that Request accepted successfully. The status of the added invoice is Processed. Here, you can also edit/delete the added invoices (under Actions).

Note: B2B invoices uploaded in GSTR-1/ IFF as a supplier will reflect in the B2B Invoices of the receiver in GSTR-2A/GSTR-2 in near real time. However, no action can be taken by receiver unless the Supplier files GSTR-1/ IFF.

Note: All the invoices that you have uploaded for a given tax period are displayed under the "Uploaded by Taxpayer" tab.

The same is depicted below:

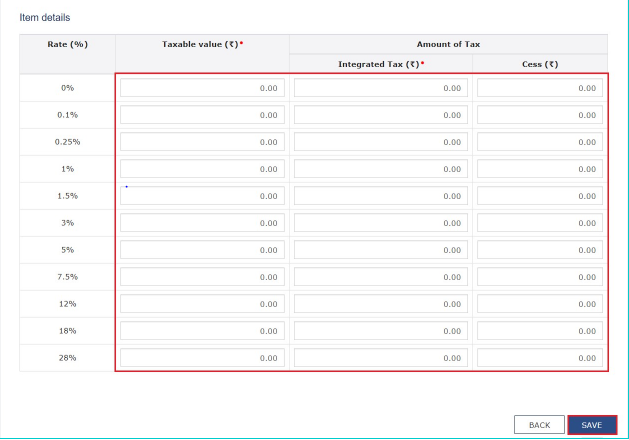

- Step (j): Click the BACKbutton to go back to the GSTR-1/ IFF page. You will be directed to the GSTR-1/IFF landing page and the B2B Invoices tile in GSTR-1/IFF will reflect the number of invoices added along with Total Invoice Value, Total Taxable Value and Total Tax Liability as depicted below:

Step 6: Details in Table 9A, Table 9B and Table 9C can also be furnished in the similar manner as stated for Table 4A,4B,4C, 6B, 6C.

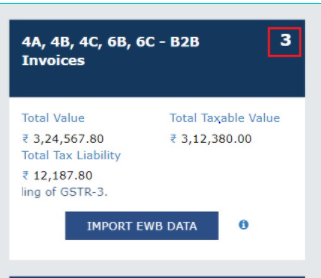

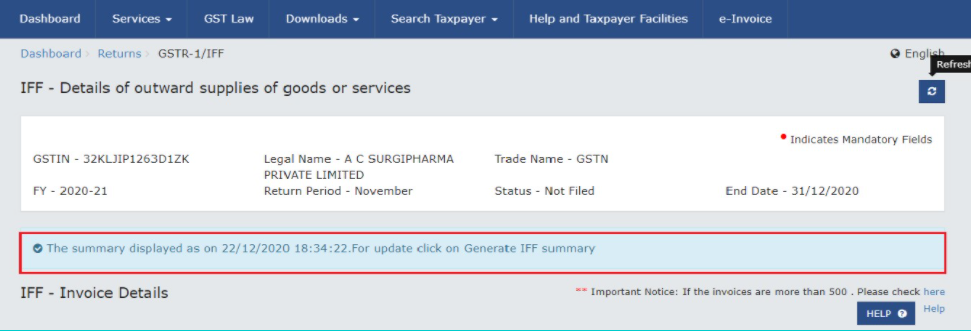

Step 7: Scroll down to the bottom of the IFF – Details of outward supplies of goods or services page and click the GENERATE IFF SUMMARY button to include the auto drafted details pending for action from recipients. The same is depicted below:

Step 8: After the summary generation is initiated, you will notice the message to check after one minute. Once the summary is generated, you will notice a success message on top of the page. The same is depicted below:

Step 9: Once you have generated the IFF Summary to added invoices, click the PREVIEW button. This button will download the draft Summary page of your GSTR-1/ IFF for your review. It is recommended that you download this Summary page and review the summary of entries made in different sections with patience before submitting IFF. The PDF file generated would bear watermark of draft as the details are yet to be submitted.

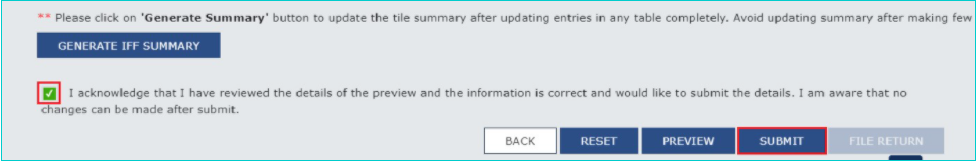

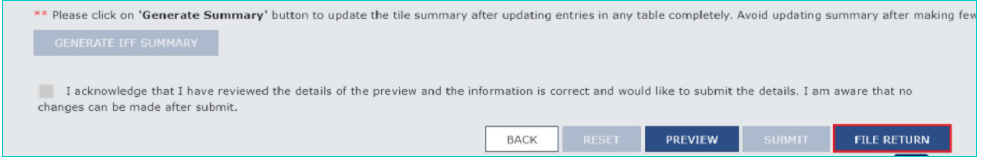

Step 10: Select the acknowledgement checkbox stating that you have reviewed the details of preview and the information furnished is correct and are aware that no changes can be made after submitting the form. Once you click the acknowledgement, the SUBMIT button will be enabled. Click the SUBMIT button in the landing page to submit GSTR-1/ IFF. The same is depicted below.

Note: The submit button will freeze the invoices uploaded in the GSTR-1/ IFF for that particular month. You will be not able to upload any further invoices for that month. In case you have missed adding any invoice, you can upload those invoices in the next month.

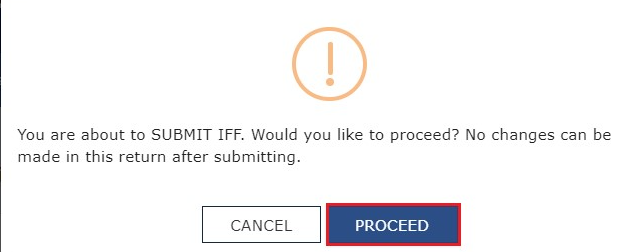

Step 11: Click the PROCEED button. The same is depicted below:

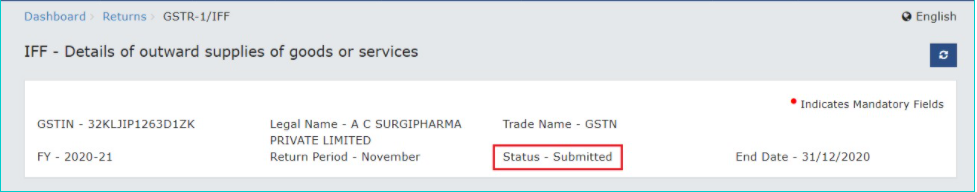

Step 12: A success message is displayed. Refresh the page and the status of GSTR-1/ IFF changes to Submitted after the submission of GSTR-1/ IFF.The same is depicted below:

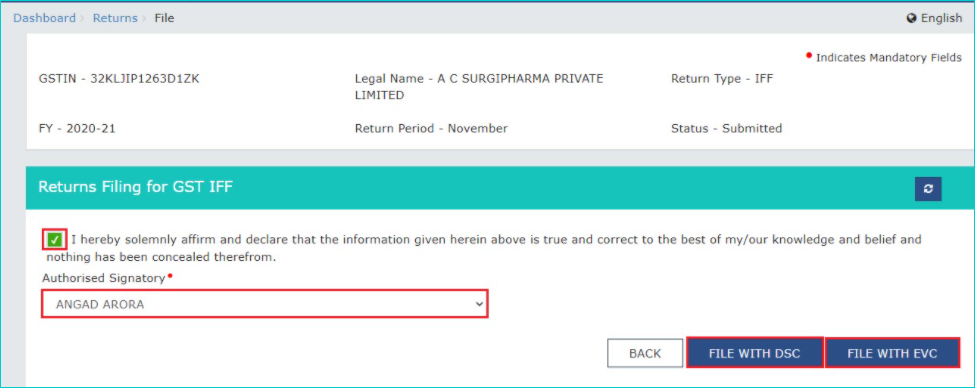

Step 13: Now click the FILE RETURN button. The Returns Filing for GSTR1/ IFF page is displayed. Select the Declaration checkbox. In the Authorised Signatory drop-down list, select the authorized signatory. This will enable the two buttons - FILE WITH DSC or FILE WITH EVC. Click the FILE WITH DSC or FILE WITH EVC button to file IFF. The same is depicted below.

Note: On filing of IFF, notification through e-mail and SMS is sent to the Authorized Signatory.

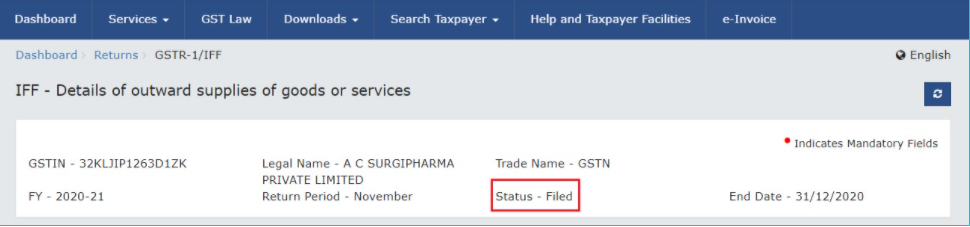

Step 14: File the IFF return through DSC or EVC code as the case may be. After this, success message and ARN is displayed. Status of IFF changes to ‘Filed’. The same is depicted below:

[1] Central Goods and Services Tax Rules, 2017