The recent judgment of Bombay High Court in the matter of Abu Dhabi Investment Authority[1] is a judgment for many firsts. The judgment is a result of challenge of AAR[2] ruling in Abu Dhabi Investment Authority (for brevity ‘ADIA’).

Issue:

ADIA is a public institution owned by and subject to the supervision of Emirate of Abu Dhabi. ADIA has challenged the ruling passed by AAR, wherein the later denied inter-alia the benefit of India-UAE[3] DTAA[4] in respect of the income accruing to the investments made or proposed to be made by Green Maiden A 2013 Trust (‘Trust’), which was established by ADIA as settlor and Equity Trust (Jersey) Limited as the trustee (ETL/Trustee). ADIA has invested USD[5] 200 million in India on revocable basis through the above trust, wherein ETL acted as trustee with sole beneficiary as ADIA.

Ruling of AAR:

AAR held since the trust is not in revocable terms and only the corpus is in revocable terms, the provisions of Section 61 and Section 63 shall not be applicable and accordingly the income will be taxable in the hands of trust. Since the trust is registered in Jersey, it cannot access the India-UAE DTAA and the income earned by trust is taxable in India. Further, AAR also held that the provisions of Section 61 and Section 63 does not apply to Foreign Trusts. The AAR also held that since ADIA was the sole beneficiary, the same cannot be called as trust. The Bombay High Court rejected the view taken by AAR. In this article, we try to analyse the views taken by AAR and the rejection by High Court in detail to drive home certain points.

Analysis by High Court:

The trust is settled by ADIA in Jersey and under the deed of settlement dated 22nd July 2013, the trust is being set up and for the benefit of ADIA who is, apart from the settlor, also the beneficiary of the trust. The trust is revocable and determinable. By virtue of provisions of deed of settlement, ADIA made a capital commitment of USD 200 million in the trust in its capacity as settlor. At the time when ADIA was making decision to invest in India, there was no legal framework in UAE under which a trust could be formed, and it is not possible for ADIA to establish a sole shareholder subsidiary company in UAE. ADIA for commercial and administrative reasons has made its all-illiquid investments through separate legal entities to ensure it does not have to directly deal with various portfolio companies. ADIA has been using the Jersey jurisdiction for establishing companies and trusts for making several investments around the world, since Jersey’s regulatory regime is compliant with international standards and generally not considered as opaque jurisdiction. The trust was also registered with SEBI[6] as Foreign Institutional Investor (FII) and later on as Foreign Portfolio Investor (FPI) under the relevant regulations of SEBI.

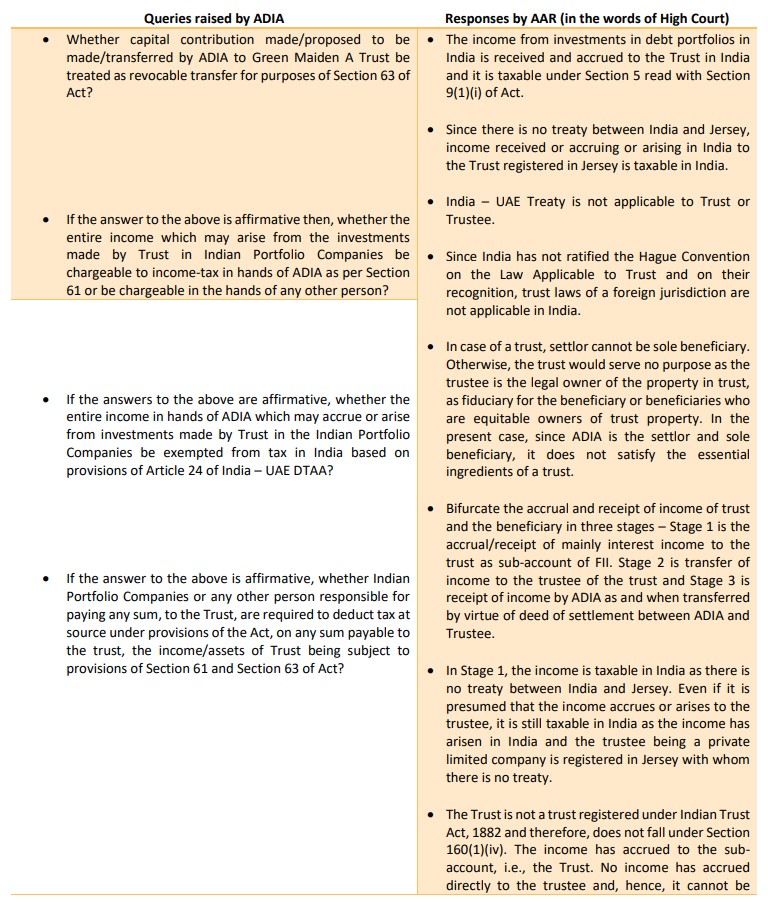

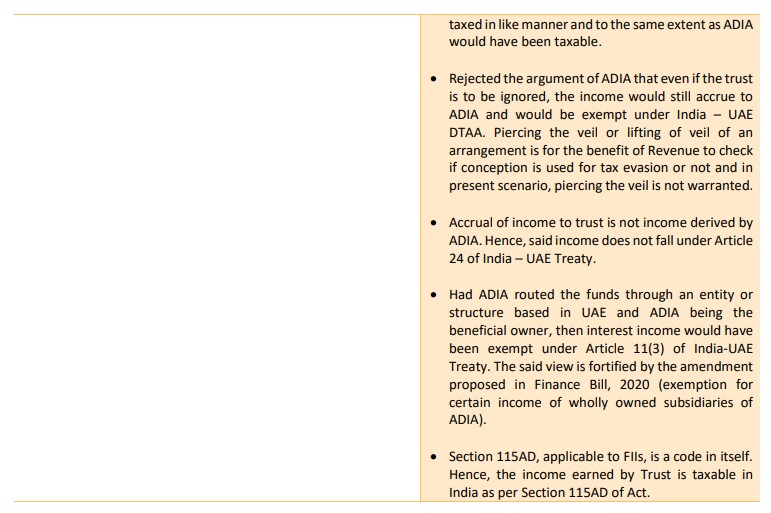

ETL as trustee has entered into an investment management agreement with Kotak Mahindra (International) Limited (KMIL) and one of the obligations cast on KMIL is that a KMIL group subsidiary will invest in each and every portfolio company alongside the trust. The Deed of Settlement provides that the capital contributions made or proposed to be made by ADIA to trust would be revocable transfer. ADIA’s contention was that the income derived from making investment and debt securities in India was not assessable to tax in India having regard to the provisions of Article 24 of India – UAE DTAA read with Section 60 and Section 161 of Act. To obtain a tax certainty, ADIA has approached the AAR on the following questions and the responses of AAR were tabulated as under:

Submissions by ADIA:

ADIA before the High Court stated that as per Section 61, the taxability of income arising by virtue of revocable transfer of assets shall be chargeable as the income of transferor and shall be included in his total income. Since the transfer to trust is on revocable terms, as per Section 61, the income earned should be taxable in the hands of the ADIA and not in the hands of trust. Alternatively, ADIA also stated that if for any reason, if the provisions of Section 61 are not applicable to the facts, in such case, in terms of Section 161(1)(iv), the trustee can only be taxable on representative capacity. Since the trustee is entitled to receive income on behalf of sole beneficiary, it should be considered as representative assessee of the sole beneficiary. Accordingly, it is pleaded that the income assessed in the hands of Trustee will take colour of the ADIA’s income and thereby, the benefit of India – UAE must be granted. ADIA further stated that under Section 166, in case of representative assessee, the revenue has an option embodied in Section 166 to assess the beneficiaries instead of trustees or having assessed the trustee it may proceed to recover tax from beneficiaries. ADIA stated that since it is beneficial interests which are taxable in the hands of trustee in representative capacity, the liability of trustee cannot be greater than the aggregate liability of the beneficiaries and no part of the corpus of trust properties can be assessed in the hands of trustee. ADIA relied on the judgment of Bhavana Nalinkant Nanavati[7] to submit that there is no bar in the settlor being the sole beneficiary and Estate of Late HMM Vikramsinjhi of Gondal[8] to submit that even foreign trusts are recognised under the Indian Tax Laws. ADIA further stated that as per Article 24 of India – UAE DTAA, ADIA is covered under the meaning of term ‘Government’ of UAE and any income derived by ADIA from India will be exempt from tax.

Submissions by Union:

The revenue submitted that there was no treaty between India and Jersey and therefore, the trust was taxable as a non-resident under Section 5(2) and accordingly the income earned by trust is taxable in India. Sine the trust is settled in Jersey, there cannot be applicability of India – UAE DTAA treaty to determine the taxation of income in the hands of trust. The Revenue further submitted that the Indian Trusts Act, 1882 is applicable to only to India and hence the said act cannot be applied to Foreign Trust and for the trust, the liability of trust prevalent will be applicable and as there is no treaty between India and Jersey, Section 63 or Section 161 or Section 164 are not applicable. The Revenue further submitted that ADIA received income through a device and not from direct or immediate receipt or transfer of income by trust and therefore, income received from Indian debt investments is not derived by ADIA and as Article 24 only exempts from tax derived by one government from the other contracting state, the treaty is not applicable.

Observations by High Court:

On Revocable Transfers – Section 61 and Section 63:

The High Court after listening to both the parties has stated that they are not in agreement with view pronounced by AAR. The High Court stated that the provisions of Section 61 and Section 63 would apply only to trusts which fall under the Indian Trust Act, 1882 is not in accordance with the law and Revenue itself has not vehemently put this out. The Court stated that nothing in Section 61 states that it requires involvement of a trust in revocable transfer. All that Section 61 states is that the income in case of revocable transfer is subjected to tax in the hands of transferor. The Court also said that Section 61 and Section 63 are independent. A transfer can be revocable transfer on its own merits without referring to the provisions of Section 63 and the role of Section 63 is to extend the provisions of Section 61 to cases which might not otherwise covered by Section 61 by extending the meaning of word revocable. A settlement or trust are merely instances what could amount to transfer for the purposes of Section 61 and the Court held that Section 63(b) includes in the definition of transfer any settlement or trust or covenant or agreement or arrangement. The Court stated that Section 63 is not only restricted to trust, as long as the conditions specified in Section 63(a) are satisfied, any transfer, whether connected with trust or not will be a revocable transfer. In any event, it was held that there is no requirement that a trust covered under Section 63 should necessarily be an Indian trust falling under Indian Trust Act. The Court concluded that such restriction which was not there in Act cannot be imported in Section 61 and Section 63.

On Hague Convention and Recognition of Foreign Trust under Indian Tax Laws:

The Court further rejected that the stand taken by AAR that India has not ratified the Hague Convention on Law Applicable to Trust and on their recognition, trust laws of foreign jurisdiction are not applicable in India. The Court stated that the word ‘trust’ is not defined under the IT Act or General Clauses Act and hence it has to be interpreted in its normal meaning. The Court stated that, even if the definition of trust under the Indian Trust Act can be held to say that it does not cover the foreign trust, still the word ‘trust’ in Section 63 still covers all trust within its ambit. The High Court referred to judgment of Late HMM Vikramsinjhi of Gondal (supra) to drive home the point that even foreign trusts are recognized in tax laws. Accordingly, it was concluded that foreign trusts are covered under the tax laws and accordingly the provisions of Section 61 and Section 63 are applicable.

On Settlor vis-à-vis Sole Beneficiary:

The High Court then proceeded to take up the next issues, as to whether the settlor can be the sole beneficiary. The Court referred to the judgment of Gujarat High Court in Bhavana Nalinkant Nanavati (supra), wherein it was held that settlor cannot be trustee and beneficiary, but settlor can be the sole beneficiary. Since, in the instant case, the settlor and trustee are different, the Court rejected the conclusion of AAR. The High Court has found fault with the approach of AAR in not understanding the reason as to why ADIA chose to invest through trust. The Court stated that when ADIA invests directly, it is clearly eligible for exemption under Article 24 of India-UAE DTAA and this was also accepted by AAR and the creation of trust is not to avoid any tax but for the purposes of commercial expediency.

On Taxation of Representative Capacity – In the like manner and to the same extent:

The Court then proceeded to examine the AAR’s view on the taxation of representative capacity. The view of AAR that the trustee can be representative assessee but in the instant case, trustee being a resident of Jersey cannot be agent of ADIA and accordingly the trustee cannot be assessed in terms of Section 160 was rejected by the High Court. The High Court stated that there is nothing provided in the Act that the trustee should only be a resident for the purposes of Section 160.

The Court finally concluded that since ADIA has settled the trust on the terms mentioned in Deed of Settlement, the contribution made by it to the trust would be transfer as defined in Section 63 of Act. The Court stated that Section 63 does not anywhere specify that a trust covered by it must necessarily be falling under Indian Trusts Act. As the ‘trust’ is not defined under Section 63 or Section 2, then it has to be understood as per common parlance and accordingly struck the view of AAR that the provisions of Section 61 and Section 63 are applicable only to Indian Trusts and not to Foreign Trusts. The Court also stated that on perusal of returns to be filed under IT Act, the ITR-5 requires to disclose the details of trusts created under the laws of country outside India, indicating that foreign trusts are recognised for the purposes of tax laws. The Court further stated that, even if, the trust is based out of Jersey and trust is settled in Jersey, ADIA being the settlor and sole beneficiary of trust and resident of UAE, as per Article 24 of India – UAE DTAA, the income which arises to it by virtue of investment in Indian Portfolio companies will be governed by beneficial provisions of treaty. The Court further held that even for a moment, the trust structure is discarded, the income would arise in the hands of ADIA and accordingly covered under Article 24 and ADIA has not attempted to reduce the tax by using the subject structure. The Court stated that even if for a moment, if it is held that the provisions of Section 61 are not applicable, then as per provisions of Section 160, the trustee can be assessed in like manner and to the same extent of beneficiary and since ADIA is the sole beneficiary, the income would be exempted in the hands of trustee in terms of Section 160. The Court accordingly rejected the view of AAR.

[1] 2021 (10) TMI 1270 – Bombay High Court

[2] Authority for Advance Ruling

[3] United Arab Emirates

[4] Double Taxation Avoidance Arrangement

[5] United States Dollar

[6] Securities and Exchange Board of India

[7] (2002) 255 ITR 0529

[8] (2014) 363 ITR 0679