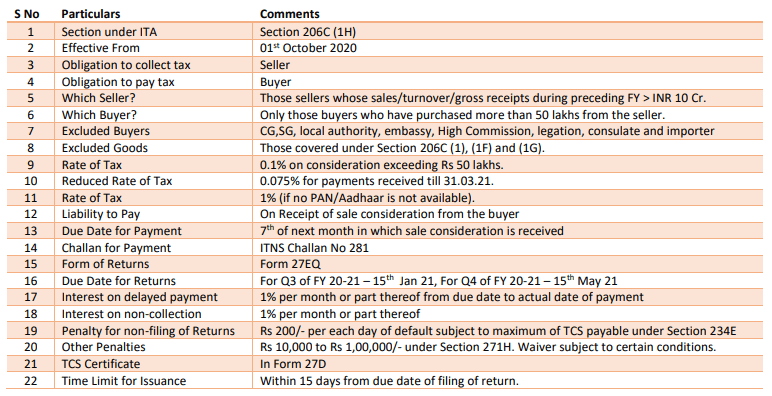

Finance Act, 2020 with an intention to widen and deepen the tax net has expanded the scope of provisions of tax collection at source for sale of goods. The obligation to collect tax at source is applicable only for specified sellers when sales were made to specified buyers, which are dealt at more appropriate place. The new provisions are made effective from 01st Oct 2020. In this write up, we shall deal with the new provision and obligations under the same.

Applicability of Section 206C(1H):

Section 206C(1H) of Income Tax Act, 1961 (for brevity ‘ITA’) mandates that every person, who is a seller, who receives any amount as consideration for sale of any goods of value or aggregating of such value exceeding Rs 50 lakhs in any previous year shall at the time of receipt of such amount, collect from the buyer, a sum equal to 0.1% of the sale consideration exceeding Rs 50 lakhs as income tax.

The term ‘seller’ is defined to mean a person whose total sales, gross receipts or turnover from the business carried on by him exceed Rs 10 Crore during the financial year immediately preceding the financial year in which sale of goods is carried out and not being a person whose is notified by Central Government in this connection. As on date, there is no notification issues exempting persons/class of persons from the current obligation. Hence, all sellers whose turnover/gross receipts/sales in Financial Year (FY) 2019-20 exceeds Rs 10 Crores, they have an obligation under this section.

However, the said obligation will come into play only if the seller who sells goods of value exceeding Rs 50 lakhs in the current year to a buyer. The term ‘buyer’ is defined to mean a person who purchase any goods and specifically excludes the central government, state government, an embassy, a high commission, legation, commission, consulate and the trade representation of foreign state or local authority or an importer or any other person as notified by Central Government. Further, the said obligation does not apply for sales made by the seller for goods which he has exported out of India or goods covered under Section 206C(1)[1] or (1F)[2] or (1G)[3].

Hence, the obligation to collect tax arises only if the following conditions gets satisfied:

- Total sales/gross receipts/turnover of seller exceeds Rs 10 Crores in preceding FY

- Seller should be in receipt of sale consideration from a buyer exceeding Rs 50 lakhs in current FY

- Seller is not engaged in goods covered under other notified sub-sections of Section 206C

- The goods are not exported out of India by seller

- The buyer is not an importer

- The buyer is not a central government, state government and others[4]

Only if the seller satisfies all the above conditions, then the obligation to collect the tax from the buyer would arise. Now, let us proceed to examine, the rate of tax which the seller has to collect from the buyer.

Rate of Tax to be Collected:

Once the seller is obliged to collect the tax, the next aspect that would arise, what is the quantum of tax which has to be collected from the buyer. The section states that the seller who is in receipt of sale consideration, at the time of receipt of such amount, collect 0.1% of the sale consideration exceeding Rs 50 lakhs.

Hence, if the seller is selling goods to a buyer worth of Rs 60 lakhs, then at the time of collection of such amount from the buyer, the seller is obliged to collect an additional tax of Rs 1,000/- as tax collected at source. Let us say, sellers sells again to the same buyer goods worth of Rs 1 Crore, then the seller has to collect Rs 10,000/- as additional tax. In other words, once a buyer has exceeded threshold of Rs 50 lakhs, then all subsequent sales in the same year, would be subjected to tax collection at source at 0.1%.

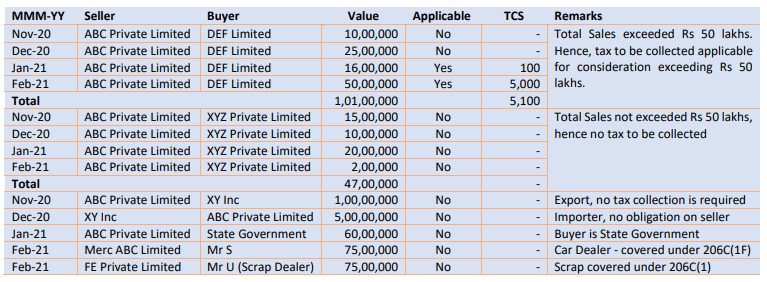

It is important to note that the said obligation on seller would arise only if the transaction with a particular buyer exceeds Rs 50 lakhs in year. If the buyer does not buy goods of value exceeding Rs 50 lakhs from the seller, then the said obligation does not arise on the seller. Let us take some examples, to understand the obligation to collect:

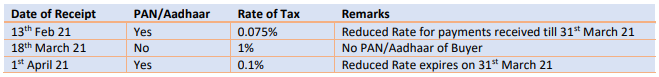

Further, vide Press Release dated 13th May 2020, the Central Board of Direct Taxes in light of economic situation arising out of COVID-19, for facilitating more funds at disposal of taxpayers has reduced the rate of tax deduction at source and tax collection at source by 25% during the period from 14th May 2020 to 31st March 2021. Hence, in light of the above press release, the rate of tax collected at source from 0.1% shall stand reduced by 25% making effective rate of tax to be collected at 0.075%. Hence, the sellers can collect tax at the rate of 0.075% instead of 0.1% on the payments received till 31st March 2021.

Further, it is important to note that in case where the PAN or Aadhaar of the buyer is not available, then in terms of Section 206CC(1)(ii), the rate of tax to be collected is 1%. Hence, if buyer does not furnishes his PAN or Aadhar, then seller has to collect tax at the rate of 1% instead of 0.1% or 0.075%. Further, the Press Release (supra) clarified that the reduced rate is not applicable to cases where PAN/Aadhaar is not furnished by the buyer. Hence, the rate of tax will be as follows:

Issues:

There are certain issues arising from the language used in the above section and its implementation from the mid of the year. We shall discuss the same hereunder.

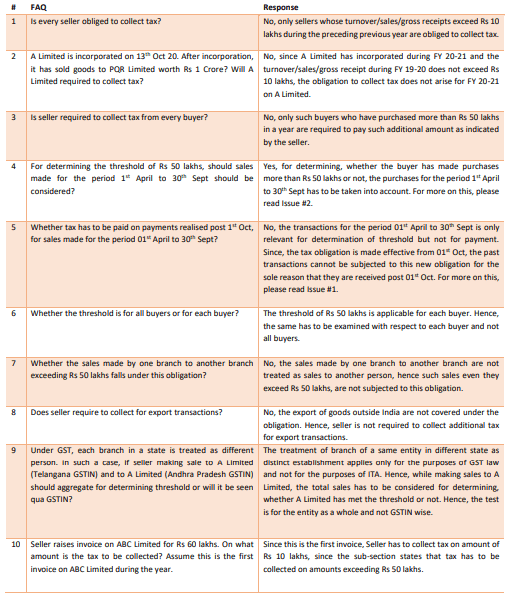

Issue #1: Whether the payments received post 1st Oct 20, for the sales made for the period prior to 1st Oct 20 is also to be subjected to tax collection at source?

As stated earlier, the sub-section is made effective from 1st Oct 20. Hence, there would be instances where the sale consideration would be realised from the buyer post 1st Oct 20 for the sales made prior to the said period. Now, the issue, which arises, is whether tax collection has to be made on such payments which are realised post 1st Oct 20 for the sales made prior to the said date? This issue arises because the obligation to payment of tax is linked with receipt of the sale consideration.

Since the sale consideration is being received post 1st Oct 20, the tax authorities may take a view that the obligation to collect tax on such amounts too. However, since the payments pertain to the period prior to 1st Oct 20, where the sub-section is not made effective, a strong view may be put forward by tax payers stating that such payments would not be subjected to this obligation.

Further, since the sub-section states that the additional amount is to be collected from buyer, it is evident that there should be a charge when the invoice was raised, though the payment of tax is linked with receipt of consideration. Hence, in our view, the payment for the sales made for the period prior to 1st Oct 20 should not be subjected to additional tax burden. However, a clarification from CBDT is welcome.

Issue #2: Whether the threshold of Rs 50 lakhs is to be considered only from the sales made from 1st Oct 20 or for the period prior also?

The obligation arises on seller if the sales exceeds Rs 50 lakhs qua a buyer. However, for determining, whether the sales qua a buyer exceeds Rs 50 lakhs, should sales only for the period post 1st Oct should be considered or sales for the period 1st April to 30th September should also be considered? Let us say, a seller has made sales to a buyer for period 1st April to 30th September amounting to Rs 40 lakhs. For the same buyer, sales made post 1st Oct was amounting to Rs 20 lakhs.

If only sales post 1st Oct are considered, then there exists no obligation under Section 206C (1H). On the other hand, if the sales made for the period prior to 1st Oct are also considered, then the obligation exists on the seller to collect tax.

In our view, since the sub-section is uses the term ‘value exceeding fifty lakh rupees in any previous year’, it is safe to consider the sales made prior to 1st Oct 20 also for the purposes of determining the meeting of threshold. However, as stated in the earlier issue, the collection will only be limited to sales made post 1st Oct 20.

Issue #3: Whether while calculating the turnover/gross receipts/sales for the preceding financial year in order to determine, whether the same exceeds Rs 10 Crores or not, should indirect taxes be included?

The obligation to collected tax from the buyer arises only if the turnover/gross receipts/sales exceeds Rs 10 Crores in the preceding financial year. In other words, if the turnover/gross receipts/sales for FY 19-20 does not exceeds Rs 10 Crores, then the provisions of Section 206C (1H) would not apply. However, the question is whether for calculation of Rs 10 Crores, should the goods and services tax (for brevity ‘GST’) collected should also be included in the above? For example, if the turnover/gross receipts/sales is Rs 8 Crores and GST collected on such sales is Rs 2.24 Cores, then if GST is added to sales, the obligation arises under Section 206C (1H), if not, there does not exist obligation.

In our view, if GST is not included in the sale price, then the same may not be added to the turnover/gross receipts/sales for determining the threshold of Rs 10 Crores. The seller if he indicates that the price is excluding GST and the same is recovered separately from the buyer, the same need not be included to determine the turnover/gross receipts/sales.

Hence, applying above to the instant case, since turnover/gross receipts/sales is Rs 8 Crores and taxes are being collected separately, the obligation under Section 206C (1H) for FY 20-21 would not apply. Reference can also be made to Para 5.9 of ‘Guidance Note on Tax Audit under Section 44AB of the Income Tax Act, 1961[5]’ issued by Institute of Chartered Accountants of India.

Issue #4: Whether tax has to be collected on the GST amounts collected from the buyer or only on the value of goods?

The said sub-section states that seller has to collect an amount as income tax on the sale consideration exceeding Rs 50 lakhs. In such case, a question arises, whether the ‘sale consideration’ should be interpreted to mean only the value of goods or entire invoice value including GST. Let us say, a seller issues an invoice for Rs 1 Crore and charges GST @ 18% on said goods. Now, the question that arises, is whether tax has to be collected on Rs 1 Crore[1] or Rs 1.18 Crore. In our view, the GST should not be included because the sub-section states that tax has to be collected on ‘sale consideration’ and GST cannot be said to be ‘sale consideration’. Hence, in our view, tax has to be collected on Rs 1 Crore instead of Rs 1.18 Crore.

However, the FAQs available on income tax website[6], while dealing with tax collection at source in terms of Section 206C (1) state that the tax collected at source should be inclusive of GST. Hence, there is a great chance that tax authorities may ask for tax collection inclusive of GST. Hence, a clarification from CBDT on this would be of great help!

In a snapshot:

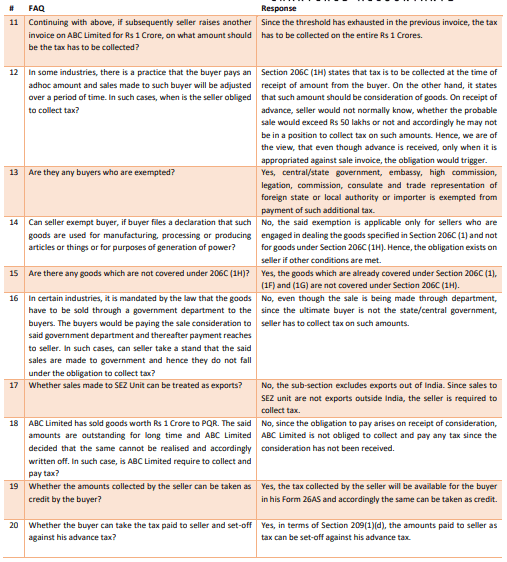

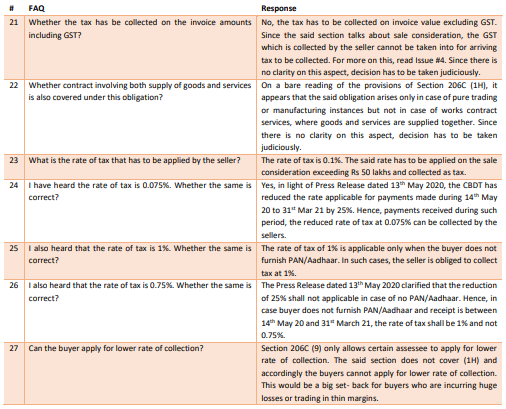

FAQs:

[1] Assuming that the threshold of Rs 50 lakhs is exhausted by the time this invoice is raised.

[1] Section 206C (1) covers alcoholic liquor for human consumption, tendu leaves, timber, other forest produce, scrap, certain minerals.

[2] Section 206C (1F) covers sale of motor vehicles.

[3] Section 206C (1G) covers payments made by Authorised Dealer under Liberalised Remittance Scheme and seller of an overseas tour programme package.

[4] legation, commission, consulate and the trade representation of foreign state or local authority

[5] https://resource.cdn.icai.org/34728gn-taxaudit-dtcicai.pdf

[6] https://www.incometaxindia.gov.in/Pages/faqs.aspx [under FAQs on Tax Deducted at Source (TDS)]