Introduction

This article aims at understanding the concept of Most Favored Nation (‘MFN’) clause in the Double Taxation Avoidance Agreement (‘DTAA’ or ‘Treaty’) between India and other countries, issues and controversies therein.

A country enters into treaty with other country for various purposes, the main object of which is for elimination of double taxation by way of sharing/forgiving taxation rights in respect of income earned by assessee.

As there is a requirement to share/forgive taxation rights by two countries, treaty may be concluded on different terms with different countries. In order to protect the interest of the countries for sharing taxation right, some countries may insert MFN clause in the treaty between them.

MFN clause means providing no less favorable treatment to the country than they provide under treaty with other countries. The objective of inserting MFN clause is to safeguard the investment made by the resident of a contracting in another contracting state.

As taxability of income differs from Article to Article in treaty depending upon nature of income, MFN clause may be entered with respect to particular type of Article in such treaty. Hence, MFN clause may differ from country to country. Generally, MFN clause may be inserted with respect to:-

- Taxation based on source and residency (scope of Income).

- Rate of tax in respect of a particular income (specifically with respect to passive income).

India has entered into treaties with majority of countries in the world and has agreed for MFN clause with some of the countries which inter alia includes France, Netherlands, Swiss confederation, Sweden and Spain etc.

India – France DTAA[1]:

‘In respect of articles 11 (Dividends), 12 (Interest) and 13 (Royalties, fees for technical services and payments for the use of equipment), if under any Convention, Agreement or Protocol signed after 1-9-1989, between India and a third State which is a member of the OECD, India limits its taxation at source on dividends, interest, royalties, fees for technical services or payments for the use of equipment to a rate lower or a scope more restricted than the rate of scope provided for in this Convention on the said items of income, the same rate or scope as provided for in that Convention, Agreement or Protocol on the said items income shall also apply under this Convention, with effect from the date on which the present Convention or the relevant Indian Convention, Agreement or Protocol enters into force, whichever enters into force later.’

The protocol amending the provisions of treaty between India and France states that if India provides relief (by way of reducing the rate of tax or reducing the scope of income) in respect of dividend, interest or royalty/FTS[2] to any other country which is a member of OECD[3] through any convention or protocol signed on or after 01-01-1989, same relief is applicable for the said income (dividend, interest or Royalty/FTS) in respect of India - France treaty. India has similar MFN clause in treaties with some other counties the details of which are discussed in the Table below:

|

Treaty between |

Scope of MFN |

Country to provide relief |

Conditions to invoke MFN clause |

Effective date of Invocation |

|

|

India – France |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS. |

India |

· If any agreement/protocol is signed on or after 01.09.1989 by India with any third state which is a member of OECD then, MFN activates automatically. |

· Effective from the date on which the protocol with France or the agreement with third state whichever enters into force later. |

|

|

India – Netherlands |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS. |

India |

· If any agreement/protocol is signed by India with any third state which is a member of OECD then, MFN activates automatically. |

· Effective from the date on which the Convention or Agreement with third state enters into force. |

|

|

India – Switzerland |

· Rate of tax with regard to dividend, interest or royalty/FTS.

· Scope of income with regard to royalty or FTS. |

India |

· In respect of rate of tax, if any agreement/protocol is signed by India with any third state which is a member of OECD then, MFN activates automatically.

· In respect of scope of income, if any agreement/protocol is signed by India with any third state which is a member of OECD then, Switzerland and India shall enter into negotiations without undue delay in order to provide the same treatment to Switzerland as that provided to the third State. |

· In respect of rate of tax, MFN activates automatically from the date on which agreement with third state enters into force.

· In respect of scope of income, MFN activates from the date on which both the countries agreed to provide relief by way of negotiations. |

|

|

India – Philippines |

· Rate of tax with regard to Article 8 (air transport) and Article 9 (shipping). |

Philippines |

· If Philippines agrees with any third state for lower or nil tax rate, it shall without any undue delay inform the India and two Govt. will review said Articles for providing similar kind of treatment. |

· Protocol states that MFN comes to force from the date on which both the countries agreed to provide such relief. |

|

|

India – Sweden |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS.

· Taxation of PE in India of Swedish Companies. |

India |

· If any agreement/protocol is signed by India with any third state which is a member of OECD then, MFN activates automatically. |

· Protocol does not provide specific effective date for MFN clause. Hence, effective date of protocol/DTAA is applicable for invoking the MFN clause i.e., 25.12.1997. |

|

|

India – Israel |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS. |

India |

MFN clause has been omitted through a protocol with effective from 14.02.2017. |

||

|

India - Belgium |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS. |

India |

· If any agreement/protocol between India with any third state which is a member of OECD comes into force after 01.01.1990 then, MFN activates automatically. |

· Effective from the date from which the protocol or the Convention or Agreement with third state is effective, whichever date is later. |

|

|

India – Finland |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS. |

India |

· If any agreement/protocol is signed by India with any third state which is a member of OECD then, MFN activates automatically. However, India shall inform the Finland for issuing the notification in this regard. |

· Protocol states that MFN comes to force from the date on which notification in this regard is issued by both the countries. |

|

|

India – Spain |

· Rate of tax or scope of income with regard to royalty/FTS. |

India |

· If any agreement/protocol between India with any third state which is a member of OECD comes into force after 01.01.1990 then, MFN activates automatically. |

· Effective from the date on which the protocol comes into force or the relevant Indian Convention or Agreement with third state, whichever enters into force later. |

|

|

India – Hungary |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS. |

India |

· If any agreement/protocol is signed by India with any third state which is a member of OECD then, MFN activates automatically. |

· Protocol does not provide specific effective date for MFN clause. Hence, effective date of protocol/DTAA is applicable for invoking the MFN clause i.e., 04.03.2005. |

|

|

India – Kazakhstan |

· Rate of tax or scope of income with regard to dividend, interest or royalty/FTS. |

India and Kazakhstan |

MFN clause has been omitted through a protocol dated 09.12.1996. |

|

|

Issues in interpretation of MFN Clause:

On plain reading of the treaty, MFN clause seems to be unambiguous. However, it has created a buzz in direct tax litigations in India in recent times.

The majority of treaties with India which contains MFN clause states that if India enters into any agreement with any third state (which is a member of OECD) after the agreement with first mentioned state, MFN clause would be applicable.

The protocol amending the provisions of treaty between India – Netherlands/France states that in order to invoke FMN clause, following conditions are to be satisfied:

- India has to enter into a treaty with any third state on after signing of treaty with Netherlands/France.

- Such third state shall be a member of OECD.

- India provides relief in respect of rate of tax or scope in respect of passive income i.e., interest, dividend, royalty/FTS.

India has entered into treaty with Slovenia, Lithuania and Colombia with lower rate of tax on dividend income (5 percent) after the agreement with Netherlands or France. However, such counties were not the members of OECD at the time of entering the treaty with India and have become members of OECD in recent times.

As these countries i.e., Slovenia, Lithuania and Colombia have become members of OECD after the signing of treaty with India, the question that arose is, whether MFN clause triggers in the case of Netherlands, France etc?

In this regard, Netherlands has issued a decree dated 28.02.2012[4] to clarify that beneficial provisions of DTAA between India and Slovenia are applicable for India – Netherlands DTAA as Slovenia has become member of OECD from 21.07.2010. Similar decree/Bulletin has been issued by France and Swiss Confederation.

Interpretation of MFN Clause by the Indian Income Tax Department:

Indian income tax department has taken different stand and states that as those countries are not the members of OECD on the date of signing of treaty with India, which is the precondition for invoking the MFN clause, the beneficial provisions contained in India – Slovenia are not applicable in respect of Netherlands.

The department has stated that the protocol appended to India – Netherlands treaty is like a contingent contract and such MFN clause can be invoked only if following conditions are satisfied:

- The third country should be a member of OECD on the date of signing of treaty with India and also on the date of invoking the MFN clause.

- The beneficial provisions are extended to residents of third state post execution of treaty with India.

Further, tax department has argued before the High Court in certain matters, that MFN clause is effective only when India issues a notification in the Official Gazette in this regard.

Interpretation of MFN Clause by Indian Judicial Fora:

The Hon’ble Delhi High Court[5] has analysed protocol appended to treaty between India – Netherlands in detail and given the judgement.

With regard to issue of separate of notification for invoking the MFN clause, the Court has relied on Divisional Bench judgement[6] in the context of India – France treaty, wherein the High Court has held that once the DTAA has itself been notified, and contains the Protocol including para 7 thereof, there is no need for the Protocol itself to be separately notified or for the beneficial provisions in some other Convention between India and another OECD country to be separately notified to form part of the Indo-France DTAA.

With regard to Slovenia becoming the OECD member after the signing of treaty with India, the Court has held as follows:

- MFN clause in India – Netherlands can be applied only if third state with whom India entered into treaty is a member of OECD and India agrees to provide relaxations in respect of specified incomes.

- The best way to interpret the protocol to the treaty is how the other state has interpreted the protocol.

- The principles of common interpretation should be applied while interpreting the international treaties.

- While interpreting the international treaties including tax treaties, the rules of interpretation that apply to domestic or municipal law need not be applied. The treaties are negotiated by diplomats and not necessarily by men instructed in the law.

Accordingly, the High Court has held that beneficial provisions contained India – Slovenia are applicable for India – Netherlands treaty with effective from Slovenia becomes the member of OECD.

CBDT Circular on interpretation of MFN Clause:

Subsequent to the High Court Judgment, the Central Board of Direct Taxes (‘CBDT’) in India has issued a Circular[7] dated 03.02.2022 for interpretation of MFN Clause. CBDT has issue the circular as follows:

- The uniliteral decree or bulletin passed by Netherlands or France do not represent the shared understanding of India in respect of interpretation of MFN clause.

- On plain reading of MFN clause with Netherlands, France or Swiss Confederation, it is clear that there is a requirement that the third state is to be a member of OECD both at the time of conclusion of treaty with India as well as at the time of invoking the MFN Clause.

- The protocol to the treaties states that MFN clause is effective from the date of entry into force of treaty between India and third state. Thus, decree or bulletin issued by respective countries to make MFN applicable from the date of such third state becoming the member of OECD is not in accordance with the provisions of MFN clause.

- It is requirement in India under section 90 that treaty or protocol to treaty are implemented after the Notification in the Official Gazette. Hence, in order to invoke provisions of MFN clause, such MFN clause has to be notified by the Government of India in the Official Gazette.

- Selective interpretation of MFN clause is not acceptable. Treaty between India – Slovenia provides separate rate of taxes for dividends i.e., 5% subject to satisfaction of shareholding condition and 15% in other cases. Invoking MFN clause with respect to 5% when such shareholding conditions are met and not switching to 15% of tax in other cases is not acceptable.

Accordingly, CBDT has given the following clarification to invoke MFN clause in treaty:

- Treaty with the third state is entered after the signing of treaty with the country with whom India agreed for MFN clause.

- The treaty is entered into between India and a third state which is a member of the OECD at the time of signing the treaty with it.

- India limits its taxing rights in the second treaty in relation to rate or scope of taxation in respect of the relevant items of income.

- A separate notification has been issued by India, importing the benefits of the second treaty into the treaty with the first State, as required by the provisions of sub-section (1) of Section 90.

If all the conditions enumerated in above Paragraph are satisfied, then the lower rate or restricted scope in the treaty with the third State is imported into the treaty with an OECD State having MFN clause from the date as per the provisions of the MFN clause in the DTAA, after following the due procedure under the Indian tax law.

Interpretation of CBDT Circular by Indian Judicial fora:

The Tribunal[8] has opined that it is not required to issue fresh notification by the Government in official Gazette for invoking the MFN clause. The Tribunal has held that Circular issued by the CBDT is binding only the revenue as held by the Supreme Court[9] and not on the assessee, Tribunal or other appellate authorities. The Tribunal has further held that such Circular is effective from the date of issuance and cannot be operative retrospectively.

Authors’ Remarks:

The crux of the litigation is whether such OECD membership is required at the time of signing of treaty with India in order to invoke MFN clause. Vienna Convention on the Law of Treaties states that a treaty shall be interpreted in good faith in accordance with the ordinary meaning to be given to the terms of the treaty in their context and in the light of its object and purpose.

In order to interpret the MFN clause, attention may be drawn to the intention of the parties incorporating the MFN clause in treaty between them.

If the intention of the state to negotiate MFN clause with India is to have parity with OECD members so that such country may have equal trade and investment options along with other OECD members, then interpretation advanced by the Hon’ble Delhi High Court in the case of Concentrix Services Netherlands B.V may be inline with the intention of MFN clause. In this regard, the other states have already expressed their intention by way of decree or bulletin which may not be considered as unilateral measures. In such a situation, it is required to test the condition of OECD membership at the time of invoking the MFN clause.

CBDT circular has stated that on plain reading of MFN clause, such third state is to be the member of OECD both at the time of entering into treaty with India and invoking provisions of MFN.

However, when it comes to paragraph 5 of Circular specifying the conditions for invoking MFN clause, it is stated that ‘The second treaty is entered into between India and a State which is a member of the OECD at the time of signing the treaty with it.’

It is not clear as to whether it is to be considered as deliberate omission of condition regarding membership at the time of invoking the MFN clause?

If yes, whether MFN clause can be invoked even if such third state ceases to be a member of OECD at the time of invoking MFN clause. If no, whether it means such conditions is to be tested both at the time of signing the treaty with India as well as at time of invoking MFN clause?

However, treaty between India – Netherlands/France does not have such type of wording in MFN clause which mandates to check such condition both at the time of signing the treaty with India as well as at time of invoking MFN clause.

Further, upon reading of the above Circular, it appears that CBDT tried to impose new set of conditions for invoking the MFN clause in the treaty some of which are against the settled law in interpretation of treaties.

It is well established law that once the treaty or protocol has been notified the Government in Official Gazette, entire treaty or protocol is applicable from the date of such notification and no other notification is required for piece of treaty or protocol unless there is a change in such treaty.

Further, treaties containing MFN clause with India provides different methods for making the MFN clause effective. The treaty between India – Finland states that ‘The competent authority of India shall inform the competent authority of Finland without delay that the conditions for the application of this paragraph have been met and issue a notification to this effect for application of such exemption or lower rate.’

The above-mentioned condition is not found in treaties with other counties viz. Netherlands, France or Swiss Confederation. If there is any requirement to issue notification for MFN clause, same might have incorporated in the protocol with such treaties.

Taking a different stand in respect of issue of separate notification which is already settled by various judicial fora may create unnecessary litigation.

MFN clause states that ‘India limits its taxation at source on dividends, interest, royalties, fees for technical services or payments for the use of equipment to a rate lower or a scope more restricted than the rate of scope provided for in this Convention on the said items of income, the same rate or scope as provided for in that Convention, Agreement or Protocol on the said items income shall also apply under this Convention’

In this regard, CBDT has gone one step further and denied invoking MFN Clause with respect of beneficial rate of tax i.e., 5% rate of tax. However, the stand taken by the CBDT may be against the object and purpose of entering into MFN clause.

It is settled law that treaties have to be construed in a way in which they have been drafted. The MFN clause clearly provides that if India provides any relief to third state, same relief is to be provided to first state and it may not be the objective of the MFN to replace the specific Article in treaty first state with Article in treaty with third state.

However, as CBDT Circular is binding on the revenue, officer who has assessment powers, may not provide relief to the assessee. Further, the judgment given by the Delhi High Court in the case of Steria (India) Ltd is pending at Supreme Court.

Hence, the beneficial provisions contained in MFN cluse are not readily available to the assessee in current times as long as the issue is not settled by Apex Court in India.

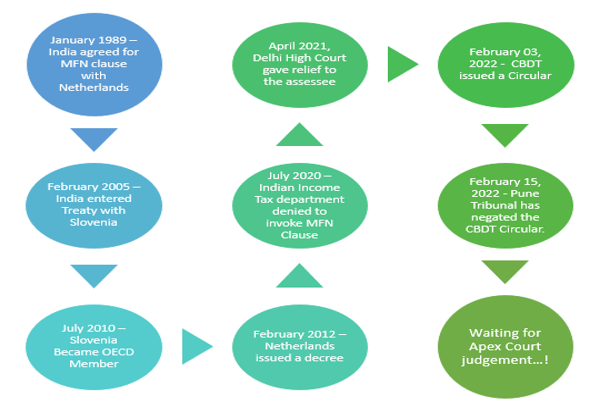

Flow of Activities in India:

MFN Clauses in Different treaties:

India – Netherlands DTAA:

‘If after the signature of this convention under any Convention or Agreement between India and a third State which is a member of the OECD India should limit its taxation at source on dividends, interests, royalties, fees for technical services or payments for the use of equipment to a rate lower or a scope more restricted than the rate or scope provided for in this Convention on the said items of income, then as from the date on which the relevant Indian Convention or Agreement enters into force the same rate or scope as provided for in that Convention or Agreement on the said items of income shall also apply under this Convention.’

India – Switzerland DTAA:

‘In respect of Articles 10 (Dividends), 11 (Interest) and 12 (Royalties and fees for technical services), if under any Convention, Agreement or Protocol between India and a third State which is a member of the OECD signed after the signature of this Amending Protocol, India limits its taxation at source on dividends, interest, royalties or fees for technical services to a rate lower than the rate provided for in this Agreement on the said items of income, the same rate as provided for in that Convention, Agreement or Protocol on the said items of income shall also apply between both Contracting States under this Agreement as from the date on which such Convention, Agreement or Protocol enters into force.

If after the date of signature this Amending Protocol, India under any Convention, Agreement or Protocol with a third State which is a member of the OECD, restricts the scope in respect of royalties or fees for technical services than the scope for these items of income provided for in Article 12 of this Agreement, then Switzerland and India shall enter into negotiations without undue delay in order to provide the same treatment to Switzerland as that provided to the third State.’

India – Philippines:

‘With reference to Articles 8 and 9 if at any time after the date of signature of the Convention the Philippines agrees to a lower or nil rate of tax with a third State the Government of the Republic of the Philippines shall without undue delay inform the Government of India through diplomatic channels and the two Governments will undertake to review these Articles with a view to providing such lower or nil rate to profits of the same kind derived under similar circumstances by enterprises of both Contracting States.’

India – Sweden:

‘In respect of Articles 10 (Dividends), 11 (Interest) and 12 (Royalties and fees for technical services) if under any Convention. Agreement or Protocol between India and a third State which is a member of the OECD, India limits its taxation at source on dividends, interest, royalties, or fees for technical services to a rate lower or a scope more restricted than the rate or scope provided for in this Convention on the said items of income, the same rate or scope as provided for in that Convention, Agreement or Protocol on the said items of income shall also apply under this Convention.

With reference to Article 25:

The taxation in India of permanent establishments of Swedish companies, shall in no case differ more from the taxation of similar Indian companies than is provided by the Indian law on the date of signature of this Convention.’

India – Belgium:

‘If under any Convention or Agreement between India and a third State being a member of the OECD which enters into force after 1st January, 1990, India limits its taxation on royalties or fees for technical services to a rate lower or a scope more restricted than the rate or scope provided for in the present Agreement on the said items of income, the same rate or scope as provided for in that Convention or Agreement on the said items of income shall also apply under the present Agreement with effect from the date from which the present Agreement or the said Convention or Agreement is effective, whichever date is later.’

India – Finland:

‘It is agreed that if after coming into force of this Agreement, any agreement or convention between India and a Member State of the Organisation for Economic Cooperation and Development provides that India shall exempt from tax dividends, interest, royalties or fees for technical services (either generally or in respect of specific categories of dividends, interest, royalties or fees for technical services) arising in India, or limit the tax charged in India on such dividends, interest, royalties or fees for technical services (either generally or in respect of specific categories of dividends, interest, royalties or fees for technical services) to a rate lower than that provided for in paragraph 2 of Article 10 or paragraph 2 of Article 11 or paragraph 2 of Article 12 of the Agreement, such exemption or lower rate shall be made applicable to the dividends, interest, royalties or fees for technical services (either generally or in respect of those specific categories of dividends, interest, royalties or fees for technical services) arising in India and beneficially owned by a resident of Finland and dividend, interest, royalties or fees for technical services arising in Finland and beneficially owned by a resident of India under the same conditions as if such exemption or lower rate had been specified in those paragraphs. The competent authority of India shall inform the competent authority of Finland without delay that the conditions for the application of this paragraph have been met and issue a notification to this effect for application of such exemption or lower rate.’

India – Spain:

‘If under any Convention or Agreement between India and a third State which is a Member of the OECD, which enters into force after 1-1-1990, India limits its taxation at source on royalties or fees for technical services to a rate lower or a scope more restricted than the rate or scope provided for in this Convention on the said items of incomes, the same rate or scope as provided for in that Convention or Agreement on the said items of income shall also apply under this Convention with effect from the date on which the present Convention comes into force or the relevant Indian Convention or Agreement, whichever enters into force later.’

India – Hungary:

‘In respect of Articles 10 (Dividends), 11 (Interest) and 12 (Royalties and fees for technical services), if under any Convention, Agreement or Protocol between India and a third State which is a member of the OECD, India limits its taxation at source on dividends, interest, royalties or fees for technical services to a rate lower or a scope more restricted than the rate or scope provided for in this Convention on the said items of income, the same rate or scope as provided for in that Convention. Agreement or Protocol on the said items of income shall also apply under this Convention.’

[1] MFN clause with other countries has been reproduced at the end of the Article for understanding.

[2] Fee for Technical Services

[3] Organisation for Economic Co-operation and Development

[4]No. IFZ 2012/54M, Tax Treaties, India

[5] Concentrix Services Netherlands B.V. and Optum Global Solutions International BV [TS-286-HC-2021(DEL)]

[6] Steria (India) Ltd [TS-5588-HC-2016 (Delhi) O].

[7] F.No.S03/1/2021-FT&TR-1

[8] GRI Renewable Industries S.L [TS-79-ITAT-2022(PUN)].

[9] Hero Cycles Pvt. Ltd. (1997) 228 ITR 463 (SC)