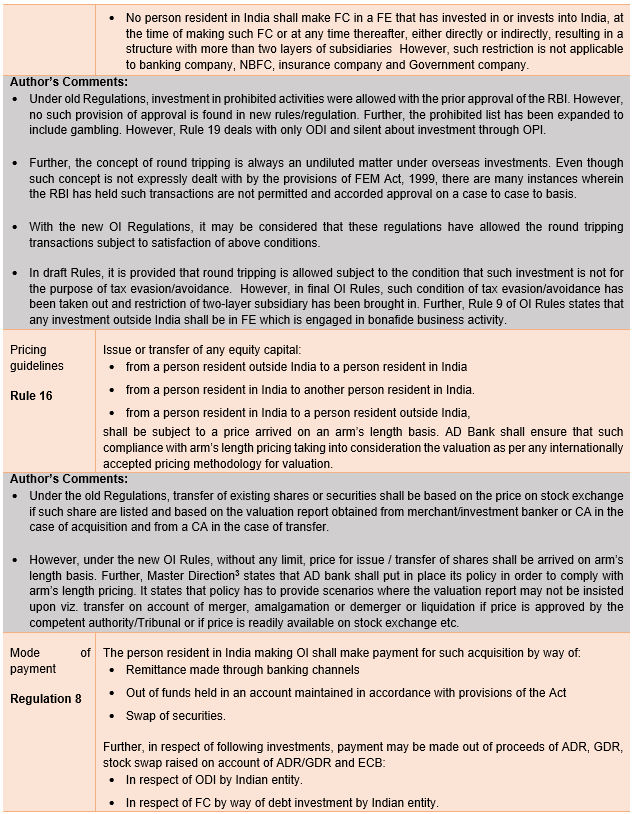

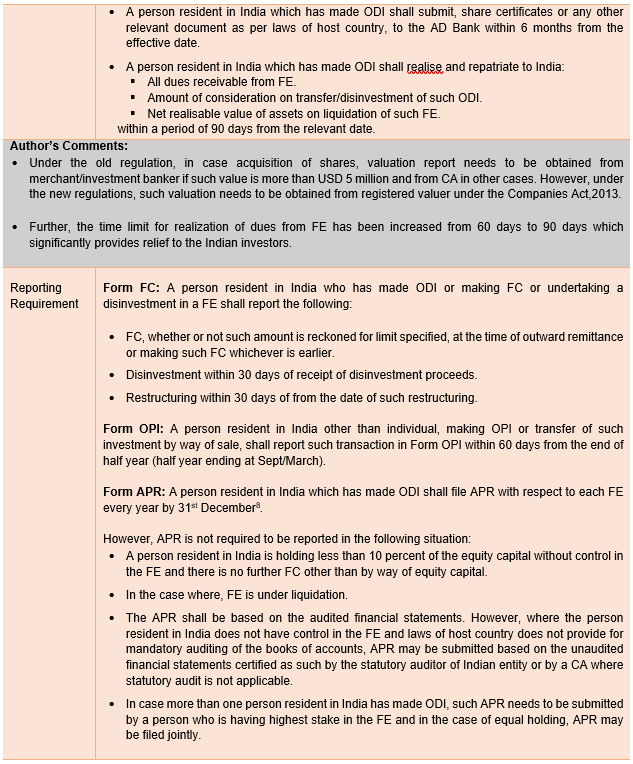

Under the pre-amended/old regulations, overseas investment, in respect of investment in foreign securities, is governed by Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2004 and, overseas investment, in respect of investment in immovable property, is governed the Foreign Exchange management (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015.

Government of India, in order to improve its standards in ease of doing business by way of relaxations, simplifications or exemptions, is making many changes to various laws and regulations which inter alia includes changes to taxation laws, Foreign Exchange Management Regulations, Corporate and other laws etc.

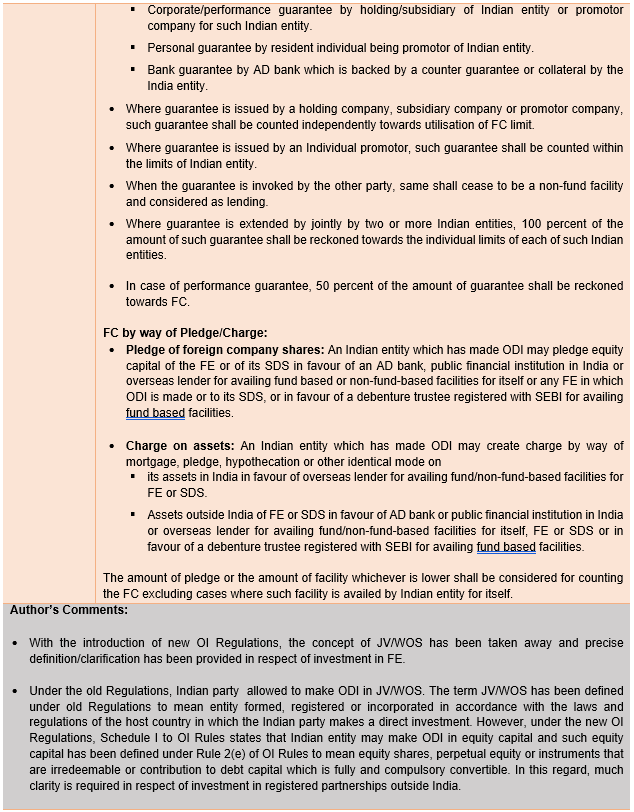

Under the old regulations, overseas investment is considered to be investment in joint venture or investment in wholly owned subsidiary which has created some sort of confusion in relation to overseas investment by various persons in other overseas entities. Further, overseas investment by individual, investment by way of loan/ debt securities, round tripping concept were also topics of discussion under old regulations.

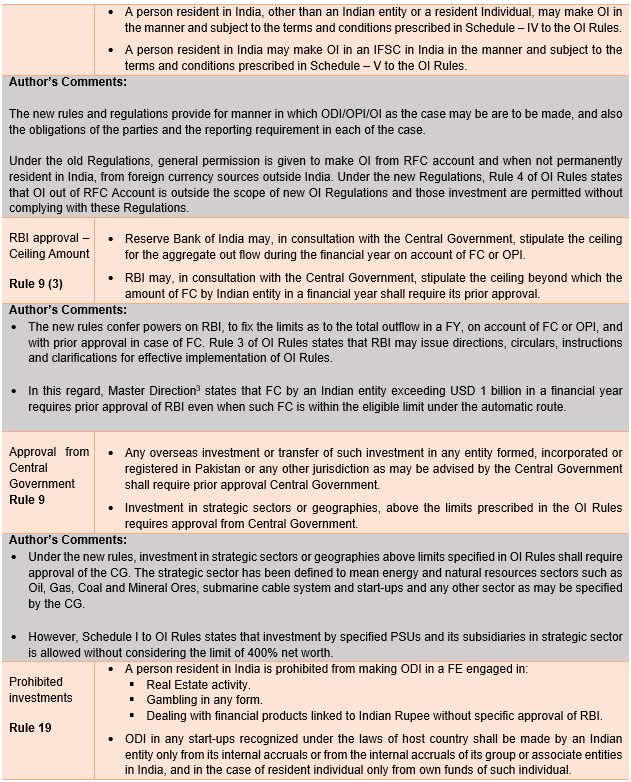

Now, in order to make overseas investment regulations simpler, and to provide certain clarifications/relaxations, Government of India has made changes to overseas investment regulations and rules thereunder. In this regard, Reserve Bank of India (‘RBI’) has notified Foreign Exchange Management (Overseas Investment) Regulations, 2022 (‘OI Regulations’) and Central Government has notified Foreign Exchange Management (Overseas Investment) Rules, 2022 (‘OI Rules') with effective from 22.08.2022 which are applicable to OI in securities as well as immovable properties.

In this Article, we shall discuss various changes made by overseas investment Regulation/Rules In order to understand the new Regulations, following aspects has to be understood.

- OI Regulations and OI Rules shall not be applicable to following investments:

- Any investment made outside India by financial institution in an IFSC.

- Acquisition or transfer of any investment outside India made,-

- Out of RFC Account

- Out of foreign currency resources held outside India by a person who is employed in India for a specific duration irrespective of length or for a specific hob or assignment, duration of which does not exceed 3 years.

- In accordance with section 6(4) of FEMA,1999 i.e., acquisition of foreign security or immovable property outside India if such security or property is acquired when such person was a resident outside India or inherited from a person who is resident outside India.

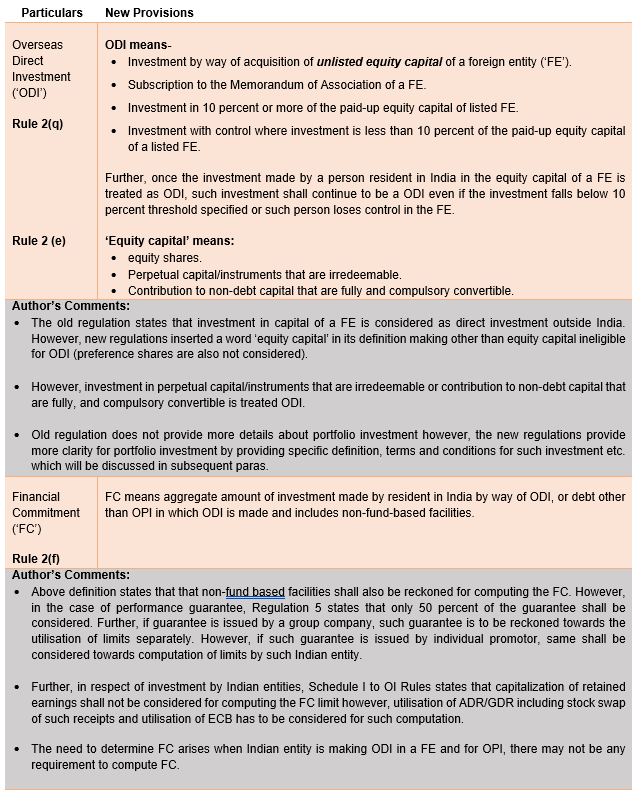

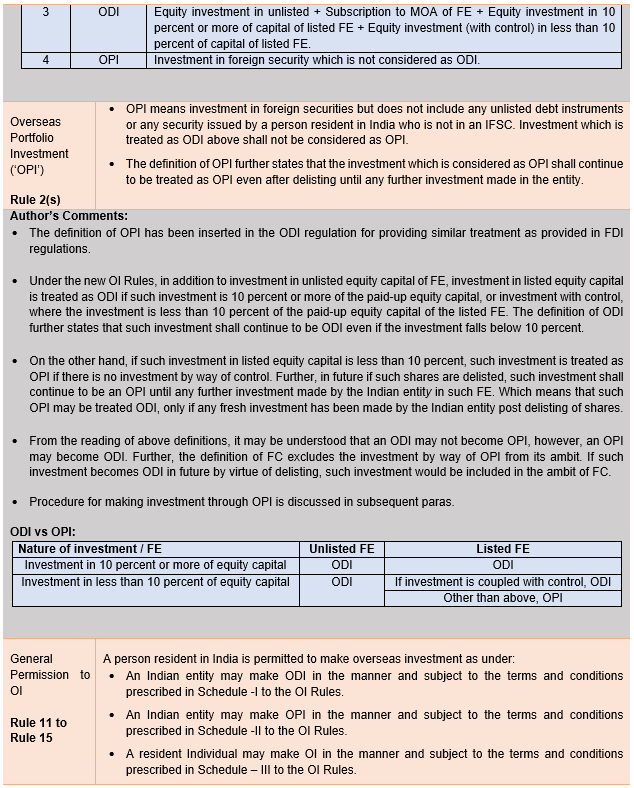

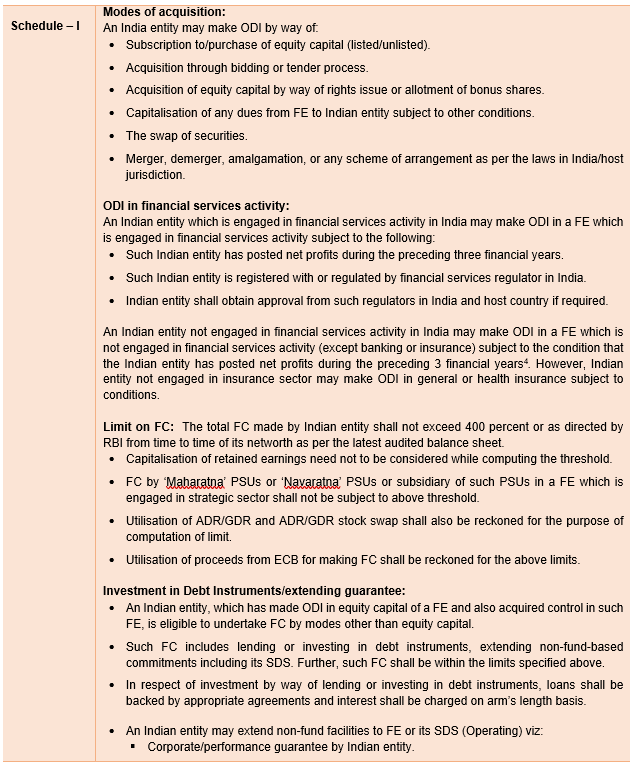

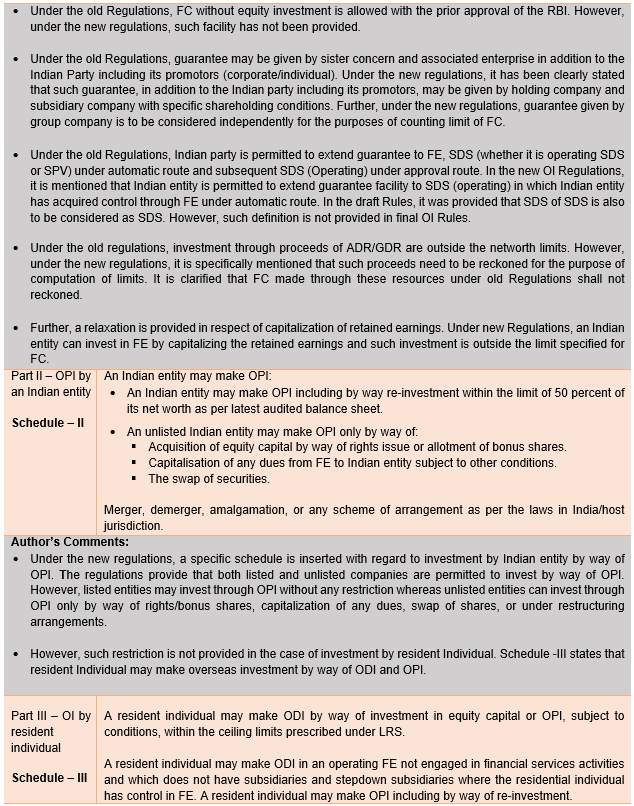

- OI by person resident in India has been divided into six parts in brief:

|

Part |

Details |

|

Part I |

Schedule I to OI Rules deals with ODI by an Indian entity |

|

Part II |

Schedule II to OI Rules deals with OPI by an Indian entity |

|

Part III |

Schedule III to OI Rules deals with OI by resident individual |

|

Part IV |

Schedule IV to OI Rules deals with OI by a person other than Indian entity or resident individual |

|

Part V |

Schedule V to OI Rules deals with OI in IFSC by a person resident in India |

|

Part VI |

Rule 21 of OI Rules deals with investment in immovable property outside India |

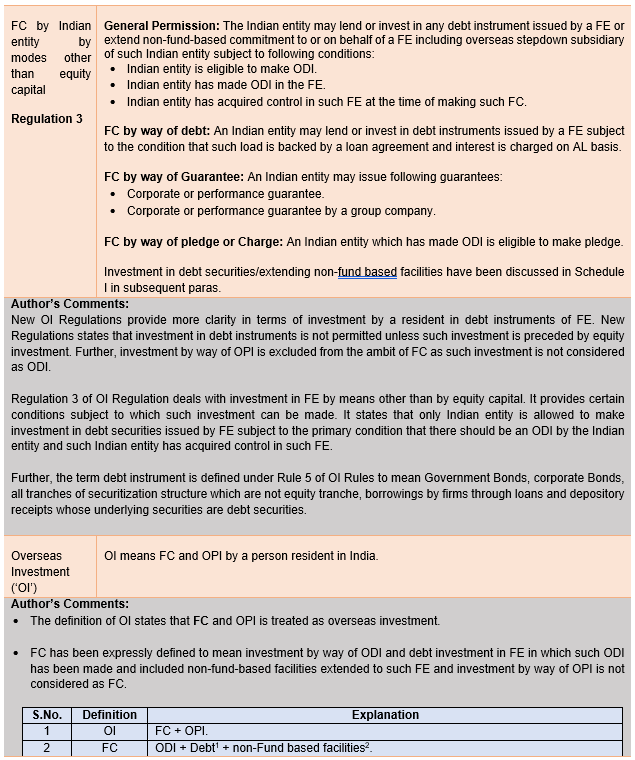

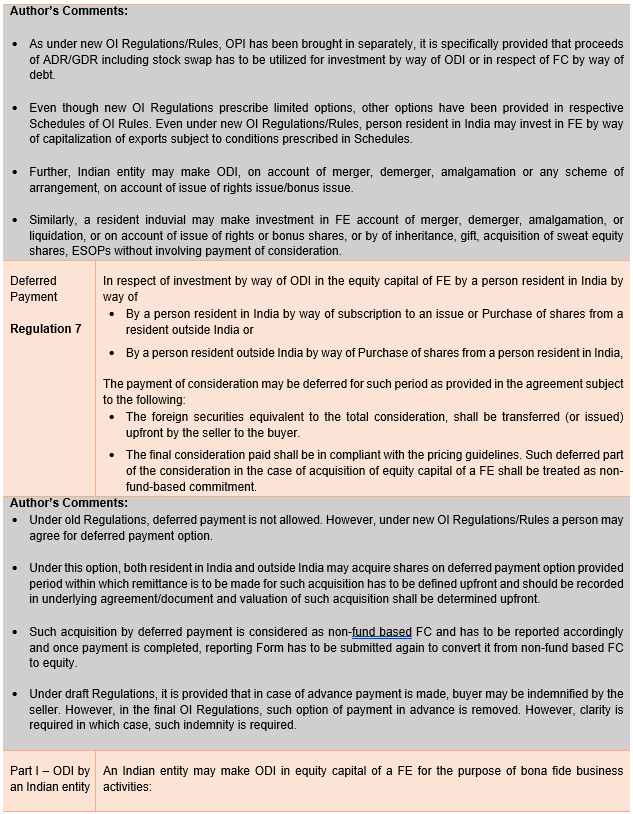

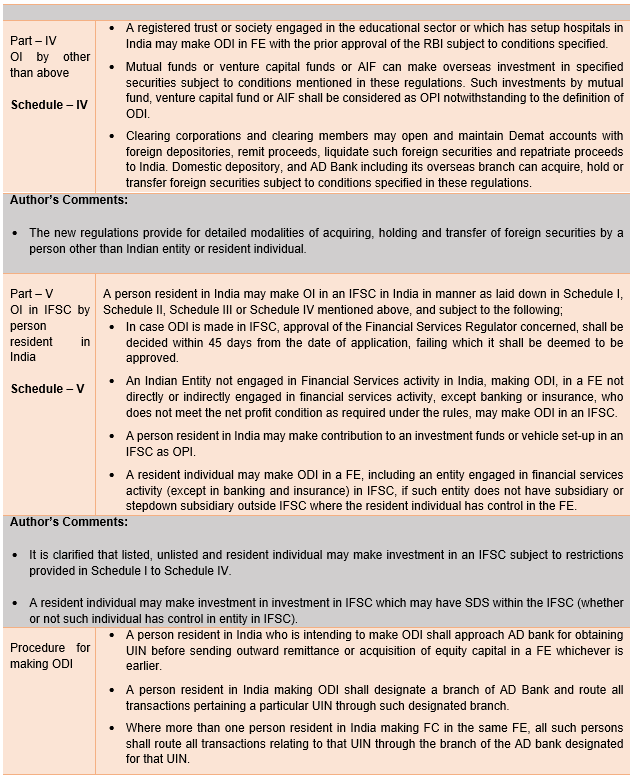

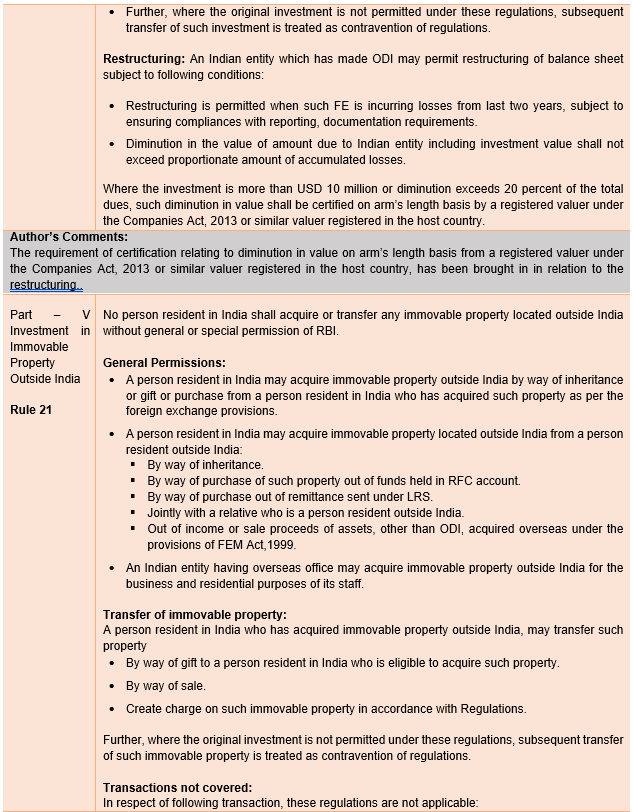

[1] Debt is allowed only when Indian entity has already made ODI in FE.

[2] Non fund-based facilities may be extended only when Indian entity has already made ODI in FE.

[3] A.P. (DIR Series) Circular No.12 August 22, 2022.

[4] If Indian entity does not meet the net profits requirements on account of COVID -19 for FY 2020-21 to 2021-22, then such period may be excluded.

[5] May make ODI whether or not such entity is engaged in financial services activity, or whether or not such entity has subsidiary or stepdown subsidiary where the resident individual has control.

[6] Includes sweat equity shares.

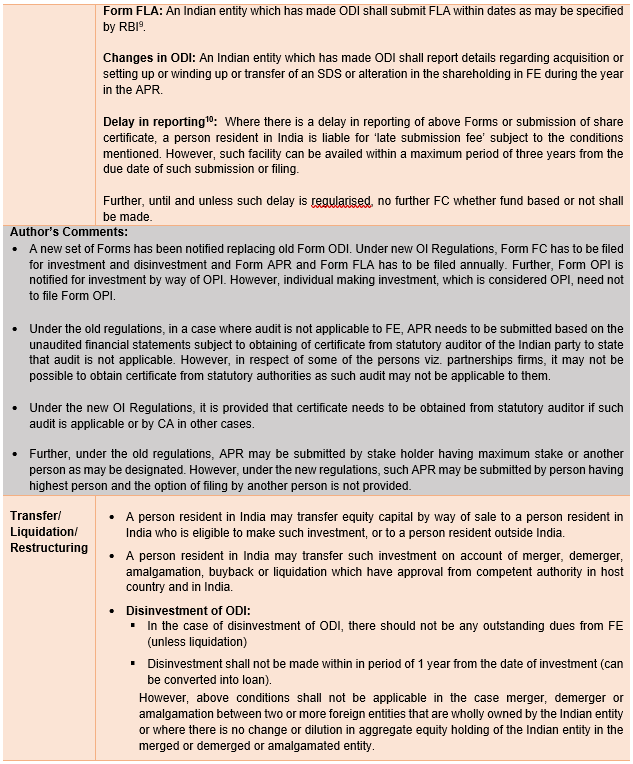

[7] Master direction states that such amount shall be reckoned towards the LRS limit of the person concerned.

[8] If accounting year of such FE ends on 31st December, APR shall be submitted by 31st December of the next year.

[9] 15th July of every year.

[10] These provisions are also applicable to compliances which are pending under old regulations.