Introduction:

In first two parts of Article (Part I[1] and Part II[2]), the concept of taxability of management support services (‘MSS’) under treaty and Income Tax Act (‘IT Act’) has been analysed in detail.

Further, through the third part, consequences of such transaction under transfer pricing provisions have been discussed.

In part III[3], it is concluded that payment to non-resident associate enterprise in relation to management support services as intra group services. Now, in this part, let us proceed to analyse determination of remuneration for those services under Arm’s Length Principle.

Let us proceed to continue with the same example considered in the previous Parts.

|

ABC Inc a company incorporated in USA has entered into license agreement with ABC India Private Limited for manufacturing of goods in India. Subsequent to such license agreement, ABC Inc has entered into another agreement for providing various MSS. Now, let us proceed, to understand computation of Arm’s Length Price under the Indian TP Regulations. |

The above services are termed as ‘intra group services’ under the TP Regulations. Section 92 of IT Act provides that any income or expense arising from international transaction shall be computed having regard to the Arm’s Length Price (‘ALP’). Section 92 further provides that allocation, apportionment or contribution of any allowance, expenses between the AE shall be computed having regard to the ALP. However, such computation of income or allocation of expense or allowance shall not reduce the total income or increase in loss computed by the assessee under normal provisions of the IT Act.

The issue arises qua intra group services is substantiating the fact that services are actually provided by the AE and benchmarking the payment made for such services under arm’s length principle. Hence, the questions:

- Whether intra group services are actually provided?

- Whether payment to such services is at ALP?

This possible solution to the first question has been discussed in our Part -III. Let us proceed to examine the second question, which is the subject matter of the current article.

Whether payment to such services is at ALP?

A special attention may have to been drawn while arriving at ALP for intra group services when compared to other transactions.

In order to determine the ALP for intra group services, it is required to understand that basis of charge for such intra group services.

OECD in its TP Guidelines has discussed both direct and indirect charge methods.

Direct Charge Method:

Under this method, arrangements made for charging for intra group services can be readily identified and there would not be any apportionment of expense based on any allocation key.

This method can be used when similar services are also provided to independent enterprise. When such similar services are provided to independent enterprise, assessee is in a position to demonstrate that services provided to associated enterprise are at ALP.

Indirect Charge Method:

Under this method, unlike to direct charge method, assessee may adopt cost allocation and apportionment method which often necessitate some degree of estimation or approximation. However, this method may not be accepted when those services are main business functions of the services provider.

Determination of ALP:

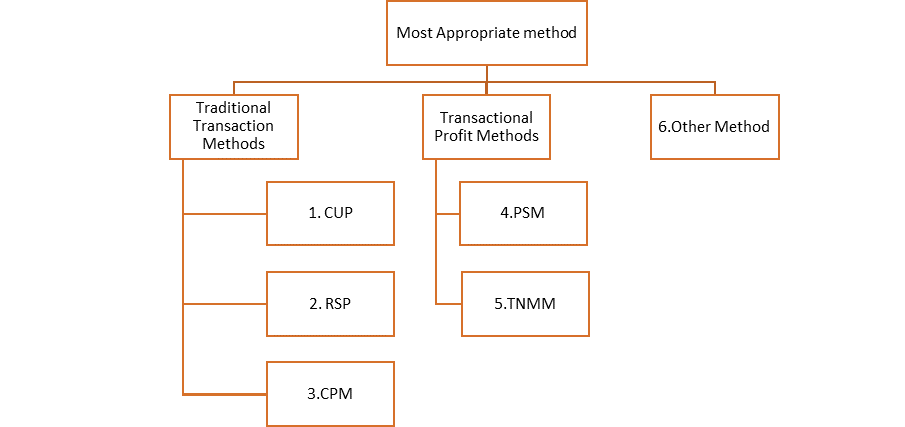

ALP in respect of intra group services is to be computed by using the ‘most appropriate method’ specified under Section 92C and such method has to be computed having regard to the procedure provided in Rule 10C of IT Rules.

CUP Method:

Under CUP method, transaction with AE has to be compared with uncontrolled transaction and such comparison is with respect to value of transaction. The assessee may use external comparable if such comparable data is available or use internal comparable. Internal comparable is nothing but transaction entered with third party for transfer of same property or service by the assessee, or transaction by AE with third party.

RPM:

Under RPM, gross margin from sale of goods to third parties which are acquired from AE is to be compared with comparable margins. This method is applied when there is no significant value addition to the products by the assessee and it acts as mere distributor.

CPM:

Under the CPM, gross profit margin is the basis for comparison. Under this method, gross profit is computed by considering both direct and indirect cost incurred by the assessee for providing services. The gross profit margin as computed above shall be compared with the comparable margin. However, the main difficulty with this method is availability of data as data relating to gross margins is generally not available in public domain. However, internal CPM may be applied if such data is available.

PSM:

PSM provides distribution of profits between two or more enterprises. This method is typically used under circumstances wherein the assessee and AE has entered into transactions jointly.

TNMM:

TNMM is similar to CPM and the major difference between CPM and TNMM is that under the CPM, gross profit margin is compared with the comparable company margins whereas under the TNMM, net profit is compared with the comparable margins. Further, details of net margin for comparable companies would be available in public domain.

Other Method:

Rule 10AB provides that any method which takes into account the price which has been charged or paid, or would have been charged or paid, for the same or similar uncontrolled transaction, with or between non-AEs, under similar circumstances, considering all the relevant facts.

In order to compute ALP, most appropriate method has to be selected on factual basis after considering the parameter provided in Rule 10C. In most cases, judicial fora have held that once the basics tests are fulfilled (which are discussed in part III), revenue cannot consider ALP as Nil and upheld TNMM as most appropriate method for benchmarking MSS. However, depending on the facts of each case, other methods may also be selected as most appropriate method for computing of ALP. In each case, performing a functional analysis plays a vital role in selection of appropriate method.

Low Value Adding Intra Group Services:

Low value adding intra group services have been discussed by OECD in its TP Guidelines[4] in detail. As name suggests, low value intra group services are supportive services in nature which does not involve use of intangible assets, does not assume significant risk by the services provider, which are not core business activities of the services provider.

Further, OECD has provided examples of services which can be termed as low value adding intra group services and which cannot be termed as low value adding intra group services. According to the OECD TP Guidelines, following services may be considered as low value adding intra group services:

- Accounting and Auditing,

- Processing and management of accounts receivables/payables,

- Human resource activities,

- Monitoring and compilation of data relating to health, safety, environmental and other standards,

- IT support services,

- Internal and external communication services,

- Legal services,

- Tax support services

- General administrative services.

However, if above services are performed by services provider as a core business activity, such services may not be considered as low value adding intra group services.

Simplified Approach for Low Value Adding Intra Group Services:

As mentioned above that low value intra group services do not involve use of intangible and do not contain significant risk, in order to reduce the compliance burden in respect of low value adding intra group services, OECD has proposed a simplified approach to determined ALP for those intra group services. Following are the benefits of adopting simplified approach:

- It reduces compliance effort of meeting the benefit test and in demonstration of ALP.

- Provides greater certainty for MNE group that the price charged for intra group services will be accepted by tax administrations.

- Provides tax administrations with targeted documentation enabling efficient review of compliance risk.

Benefit test to Low Value Intra Group Services:

As discussed in part III, benefits test needs to be satisfied in order to substantiate that intra group services are actually received by the assessee.

However, in respect of low value adding intra group services, it may be difficult or may require more efforts to demonstrate that services are actually received.

In this regard, OECD in its TP Guidelines states that when MNE maintains documentation as mentioned in simplified approach, it would be sufficient to demonstrate that the benefit test is satisfied.

Determination of remuneration to Low Value Intra Group Services:

In order to determine remuneration to low – value adding intra group services, following steps need to be followed:

- Determination of cost pools.

- Allocation of cost to members.

- Inclusion of profit markup.

Determination of Cost Pools:

The initial step involved in determination of remuneration is determination of cost pools. In this step, cost incurred by all members of the group in performing each category of services has to be pooled which shall included both direct and indirect cost incurred in performing those services.

However, cost that are attributable to an activity which benefits solely the company performing the activity should be excluded.

Further, cost which are incurred by an entity to provide services to a particular member in a group shall also be excluded from cost pool.

Allocation of Cost to members:

Once total cost incurred by all members are pooled, next step is allocation of such cost to members in the group.

Such costs have to be allocated to members in the group based on an allocation key. However, there is pre-determined formula in selection of allocation key and such selection shall be based on relevant facts. However, such allocation shall be utilized consistently.

Inclusion of Profit Markup:

Once costs are allocated based on allocation key, group company may add mark-up to those costs. OCED in its TP Guidelines provides a standard markup of 5 percent for low value adding intra group services.

Finally, remuneration to low value adding intra group services has to be determined by aggregating costs allocated to members and profit markup:

Cost incurred solely for the purpose of providing services to specific members plus markup + cost allocated to members plus markup.

Arm’s Length Price for Low Value Intra Group Services:

As stated above, OECD in its TP Guidelines provides that a mark up of 5% can be considered for low value adding intra group services. The proposed mark up must be applied on cost allocated to such low value adding intra group services. As the ALP for low value adding intra group services is determined at 5% markup, TP Guidelines states that such services need not be benchmarked separately through a study.

Further, TP Guidelines states that tax administrations have to setup a threshold to avail the benefit of simplified approach.

Documentation:

In respect of low value adding intra group services, group adopting simplified approach has to maintain following documentations:

- A description of the categories of low value adding intra group services provided and identity of the beneficiaries.

- Reasons justifying that each category of services constitute low value adding intra group services.

- A description of benefits to members and selection of allocation key.

- Written contracts/agreements for the provision services.

- Documentation and computation of cost pools and markup added thereon.

- Calculation showing the application of the specified allocation keys.

India’s Approach:

In India, low value adding intragroup services have been discussed in safe harbour rules. Rule 10TD of IT Rules[5] states that where an eligible assessee has entered into eligible international transaction, such transaction shall be accepted by income tax authorities if such transaction is in accordance with the limits and conditions specified therein.

Rule 10TC defines that term ‘eligible international transaction’ which inter alia includes receipt of low value-adding intra-group services from one or more members of its group. Further, eligible assessee has been defined under section 10TB which inter alia includes a person who has received low value-adding intra-group services from one or more members of its group and opted for safe harbour provisions by filing Form 3CEFA.

Rule 10TA of IT Rules defines the term ‘low value adding intra group services’ to mean services that are performed by one or more members of a multinational enterprise group on behalf of one or more other members of same multinational enterprise group and which

- are in the nature of support services;

- are not part of the core business of the multinational enterprise group, i.e., such services neither constitute the profit-earning activities nor contribute to the economically significant activities of the multinational enterprise group;

- are not in the nature of shareholder services or duplicate services;

- neither require the use of unique and valuable intangibles nor lead to the creation of unique and valuable intangibles;

- neither involve the assumption or control of significant risk by the service provider nor give rise to the creation of significant risk for the service provider; and

- do not have reliable external comparable services that can be used for determining their arm's length price, but does not include the following services, namely:

- research and development services;

- manufacturing and production services;

- information technology (software development) services;

- knowledge process outsourcing services;

- business process outsourcing services;

- purchasing activities of raw materials or other materials that are used in the manufacturing or production process;

- sales, marketing and distribution activities;

- financial transactions;

- extraction, exploration, or processing of natural resources; and

- insurance and reinsurance.

Threshold and Markup:

In respect of low value adding intra group services, Rule 10TD states that safe harbour provisions would be applicable only when such value of transaction does not exceed Rs.10 Crore and markup does not exceed 5percent.

Further, Rule 10TD states that provisions of section 92D (maintenance of documentation) and section 92E (submission of Form 3CEB) are applicable irrespective of the fact that the assessee exercises his option for safe harbour in respect of such transaction.

Having understood implications under the Income Tax Act, the next aspect would be understanding implications of MSS under other legal Acts which be discussed in next part.

[1] Management Support Services vis-à-vis Ancillary and Subsidiary Clause–An Analysis on position under Treaties - Taxmann

[2] Management Support Services vis-à-vis Other Income – An Analysis on position under Treaties – Part II - Taxmann

[3] Management Support Services vis-à-vis Intra Group Services – An Analysis under Transfer Pricing – Part III - Taxmann

[4] OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations

[5] Income Tax Rules, 1962