Claiming of a deduction in respect of expenditure which are covered under Section 43B is always a discussion point at various appellate fora. Section 43B was introduced into the Income Tax Act, 1961 (for brevity ‘ITA’) through the Finance Act, 1983, making it effective from April 01, 1984. The primary objective of Section 43B is to compel the assessee to discharge certain liabilities by actually making the payment in order to claim such expenditure. Earlier to this, the assessee was creating a provision and claiming the said expenditure as deduction while computing business profits, without actually paying them. The Government after observing this, has introduced the said section to allow the said expenses as deduction only if the same are being paid.

The payments covered under Section 43B inter-alia includes ‘interest payable on any loan or borrowing from public financial institution in accordance with the terms and conditions of the agreement governing such loan’. This clause (d) has been inserted in Section 43B through the Finance Act, 1988 with effective from 01st April 1989.

However, it is observed that some of the assessees are making arrangements with such institutions to convert interest liability into a fresh loan, thereby not actually making the payment of interest but deferring such liability to future by way of loan. As conversion of interest liability into a fresh loan is not an actual payment by deferment of liability, a new Explanation 3C has been inserted to Section 43B by Finance Act, 2006 with retrospective effective from 01st April 1989 which states that for the removal of doubts, it is hereby declared that a deduction of any sum, being interest payable under clause (d) of section 43B, shall be allowed if such interest has been actually paid and any interest referred to in that clause which has been converted into a loan or borrowing shall not be deemed to have been actually paid.

In other words, when any interest payable to public financial institution is converted into a fresh loan, deduction for such interest in not available at the time of such conversion and is available only when such loan (which is converted from interest) is repaid.

In this regard, a matter has reached the Honourable Supreme Court[1] for its deliberation on Section 43B in respect of issue of debentures against the interest liability through a rehabilitation plan. In this case, let us examine the interpretation of Section 43B(d) read with the Explanation 3C in detail. For the sake of understanding of case in detail, the analysis of the case has been provided as follows:

- Study of Facts

- Conclusions by Commissioner of Income Tax (Appeals)

- Conclusions by Honourable Tribunal

- Analysis of order of Honourable High Court.

- Analysis of arguments at Honourable Supreme Court and Judgement thereof

- Conclusion

Study of Facts:

The assessee company had obtained a loan from financial institutions for the purpose of its business operations on which is interest is payable. Terms of agreement under which is loan has been obtained provides that in the event of default by the assessee, 20% of the default amount may be converted into equity at the option of the lender. The agreement further provides that repayment of principle amount and interest is to be as per the revised terms and conditions stipulated by the lender at the time of default.

During the AY 1996-97, the assessee is unable to discharge its interest liability on loans obtained from financial institutions. As the assessee is unable to discharge the liability, it has approached lead financial institution for a rehabilitation plan under which the assessee has issued 3,00,149 convertible debentures of Rs 100 each amounting to Rs 3 Crore (approx.) in lieu of interest payment and claimed as deduction for the AY 1996-97 as interest liability is discharged.

However, the Assessing Officer (for brevity ‘AO’) has rejected the claim made by the assessee by holding that issue of debentures is not as per the terms and conditions as per the loan agreement and further, issue of debentures does not tantamount to ‘actual payment’. For this purpose, the AO has relied on the wording of section 43B(d) ‘in accordance with the terms and conditions of the agreement governing such loan or borrowing.’ Aggrieved by the order the AO, the assessee had filed an appeal before the Commissioner of Income Tax (Appeals) [CIT(A)].

Conclusions by CIT (A):

The CIT (A) has allowed the claim made by the assessee by making the following conclusions:

- The original conditions not only provide for conversion of 20% of loan into equity but also revision of terms and condition of repayment at the time of default.

- The issue of debentures as mutually agreed by the assessee and financial institutions was therefore in accordance with the terms and conditions of the agreement governing the loan.

- Further, in respect of ‘actual payment’ as required by Section 43B, the CIT(A) has concluded that the debenture is a valuable security and can be freely negotiable and openly quoted in the stock market.

- It is not correct to say that a debenture is a piece of paper and issue of debentures against the interest is deferment of liability. Financial institutions have accepted the issue of debentures in effective discharge of interest liability which is no longer payable.

- Issue of debentures against the interest liability would be tantamount to payment of interest and such interest has been paid during the year.

Conclusions by Honorable Income Tax Appellate Tribunal (ITAT):

The order of the CIT(A) has been upheld by the Honorable ITAT[2] by making following observations:

- Section 43B has been inserted in order to curb the mischief of non-payment of amount by the assessee and taking the amount as deduction by following the mercantile system of accounting.

- In order to qualify the payment as ‘actually paid’, such liability need not to be discharged in cash, cheque or draft as provided in second proviso to Section 43B which is with reference to payment of provident fund, superannuation fund, gratuity etc.

- The debentures when subsequently redeemed during the AY 2001-02, the appellant has not claimed any deduction for the same. The interest amount which is allowed in the appellant case is reflected in the assessment of financial institution as business income thereby by nobody is put to any loss.

- Invoking of Section 43B on imaginary ground that there is no actual payment of interest would wholly be misplaced and would amount to a strained interpretation.

Given the above, the ITAT had upheld the order passed by the CIT(A) and provided relief to the assessee. The point here is to be noted is that the order of the CIT(A) and order of ITAT has come out before the insertion of Explanation 3C to 43B.

Conclusions by Honorable High Court:

Not satisfying with the order of Honorable Tribunal, revenue has filed an appeal before the High Court. The High Court has ruled[3] in favour of the revenue by making the following observations:

- A new Explanation 3C has been inserted to section 43B with retrospective effect from 01st April 1989. After the insertion of explanation, conversion of interest into loan shall not be considered as ‘actual payment’.

- As the explanation has retrospective applicability, the case of the appellant is squarely covered under Explanation 3C and hence, such conversion of interest into loan is not deductible under Section 43B.

However, the appellant has filed a review petition before the High Court for the reason that the Honorable High Court is erred in two aspects:

- One, the court has failed to attach due importance to the binding dicta in the case of Standard Chartered Bank[4]. The assessee has submitted that debentures are securities, and they are freely tradable.

- Two, the judgment inasmuch as it proceeded to answer a question different from what was originally framed. The court has answered the following question of laws ‘Whether the funding of the interest amount by way of a term loan amounts to actual payment as contemplated by Section 43- B of the Income-tax Act, 1961?’

- However, the question of law framed was ‘Whether the funding of the interest amount by way of a term ‘debenture’ amounts to actual payment as contemplated by Section 43- B of the Income-tax Act, 1961?’

In respect of these two arguments, High Court[5] has held that any adjustment other than actual payment does not qualify for deduction under Section 43B. Thus, though debentures are securities and are actionable claim the essential fact is that they are instruments of debt, by the company acknowledging its indebtedness to pay the amount specified. The court however raised a question, that does this amount to ‘payment’ under section 43B? The court stated that it is of opinion that there is no question of any error in the judgment under review. Further, the Court stated that the above conversion of interest into debentures would have treated as actual payment but for the retrospective application of Explanation.

Analysis of arguments at Honorable Supreme Court and the Judgement thereof:

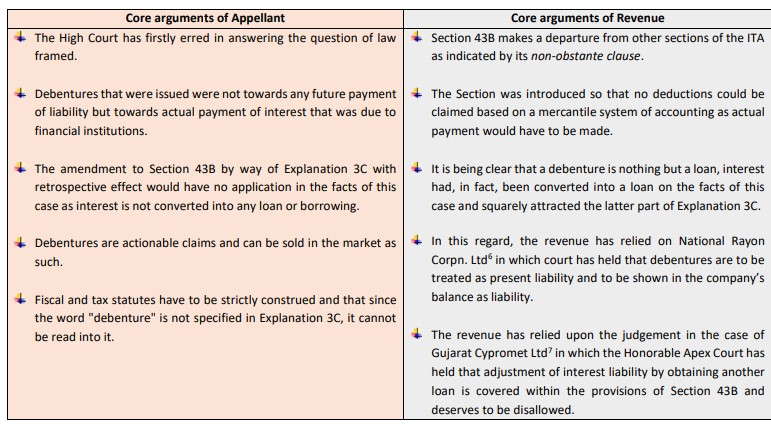

Finally, the matter has reached the Hon’ble Supreme Court to decide whether the issue of debentures in lieu of interest liability would be tantamount to actual payment as specified under Section 43B. Let us discuss the arguments made by the appellant and the revenue at Supreme Court and the verdict thereof

Judgement of Honorable Supreme Court:

The Honorable Supreme Court has provided a detailed discussion of case and given its judgement as follows:

- The object of Section 43B, as originally enacted, is to allow certain deductions only on actual payment. A mercantile system of accounting cannot be looked at when a deduction is claimed under this section, making it clear that incurring of liability cannot allow for a deduction, but only ‘actual payment’, as contrasted with incurring of a liability, can allow for a deduction.

- Interestingly, the 'sum payable' referred to in Section 43B(d), with which the court is concerned with, does not refer to the mode of payment, unlike proviso 2 to the said section, which was omitted by the Finance Act, 2003 w.e.f. 1st April 2004, which stated that payment, in resect of provident fund, gratuity, superannuation fund, shall be made in cash, cheque or draft etc.

- As per a rehabilitation plan agreed to between the lender and borrower, debentures were accepted by the financial institution in discharge of the debt on account of outstanding interest. Further, such issue of debentures has been reflected as business income in the books of account of financial institution for the year under consideration. This being, the fact-situation in the present case, it is clear that interest was ‘actually paid’ by means of issuance of debentures, which extinguished the liability to pay interest.

- Explanation 3C which was introduced only made it clear that interest remained unpaid and has been converted into a loan shall not be deemed to have been actually paid. The Central Board of Direct Taxes (for brevity ‘CBDT’) Circular explaining the insertion of Explanation 3C states that the purpose of amendment is to curb the misuse of Section 43B by not actually paying interest but converting such interest into a fresh loan.

- On the facts found in the present case, the issue of debentures by the assessee was, under a rehabilitation plan, to extinguish the liability of interest altogether. No misuse of the provision of Section 43B was found as a matter of fact by either the CIT or the ITAT. Explanation 3C, which was meant to plug a loophole, cannot therefore be brought to the aid of Revenue on the facts of this case.

- The Supreme Court has pointed that if there is any ambiguity in the retrospectively added Explanation 3C, three well established canons of interpretation come to the rescue of the assessee in this case:

- First, since Explanation 3C has been inserted through Finance Act, 2006 with the object of plugging a loophole - misuse of section 43B by not actually paying the interest but converting the same into a fresh loan. Hence, bona fide transactions of actual payments are not meant to be affected. For this purpose, the court has relied upon its judgement in the case of K.P. Varghese[8].

- Second, a retrospective provision in a tax act which is ‘for the removal of doubts’ cannot be presumed to be retrospective, even where such language is used, if it alters or changes the law as it earlier stood. This being the case, Explanation 3C is clarificatory - it explains Section 43B(d) as it originally stood and does not purport to add a new condition retrospectively, as has wrongly been held by the High Court.

- Third, any ambiguity in the language of Explanation 3C shall be resolved in favour of the assessee. For this purpose, the Supreme Court has relied on its judgement in the case of Vodafone International Holdings BV[9].

- The Supreme Court has ruled out the cases relied on by the revenue as follows:

- In respect of first case i.e., National Rayon Corpn. Ltd. v. CIT (supra), the Court has held that the question decided in that case is far removed from the question to be answered in the facts of present case.

- The question in present case does not depend upon what a debenture under law and/or whether it can be convertible or non-convertible or payable immediately or in the future. The question in the present case is only ‘whether interest can be said to have been actually paid by the mode of issuing debentures.’ Hence, the court has ruled out the case relied upon by the revenue.

- In respect of second case i.e., CIT v. Gujarat Cypromet Ltd (supra), the court has held that Explanation 3C was attracted in that case as outstanding interest had not actually been paid, but a new credit entry of loan now appeared. This is far removed from the facts of the present case, which were not adverted to at all in this judgment. Accordingly, the Supreme Court has set aside the order passed by the Hon’ble High Court and restored the order of ITAT.

Conclusion:

After the above detailed analysis of Section 43B read with Explanation 3C which was inserted through the Finance Act, 2006 with retrospective effective from 1st April 1989, the Supreme Court has held that issue of debentures against the outstanding interest liability as final discharge of liability would be treated as actual payment of interest and such amount need not to be disallowed under Section 43B.

The Supreme Court has followed the three rules of interpretation in order to remove ambiguity under section 43B. Last year, the same Supreme Court in the case of Gujarat Cypromet Ltd (supra) has held that as Explanation 3C is inserted with retrospective effect, setting off of interest with fresh loan obtained would not be treated actual payment of interest. However, the facts of the present case are entirely different as debentures are issued as final discharge of interest obligation and such issue cannot be considered as conversion into a fresh loan. The Hon’ble Supreme Court through its judgement in this case has laid down the following principles of interpretation that intention behind the entering into a transaction has more value than the literal interpretation of the statute. Further, the Court held that an amendment which provides that ‘for the removal of doubts’ cannot presumed to be retrospective, even though the provision provides for retrospective effective, in order to alter the law which was not there before. Finally, the Court stated that tax laws has to be interpreted more strictly and if there is any ambiguity while interpretation, the benefit of doubt should be in favour of the tax payer.

On a more technical side, the question remained unanswered is whether a retrospective amendment can be applied when such amendment is not present in the statute at the time of completion of assessment by the AO and subsequently, the law has been amended retrospectively when such matter is pending at appellate forum. This question is expressly dealt by the Karnataka High Court in the case of Vikram Reddy[10] where in the High Court has mentioned that there was a lacuna in law which has been addressed by Finance Act, 2012 by introducing a new clause with effective from 01st April 1999. The Court has opined that as the assessment is completed before the said amendment, the amendment may not have an effect on the assessment. The court has expressed its opinion, when a new clause has been inserted in a particular section which was not there under the existing provisions. However, the same proposition may not hold good when a new explanation is inserted with retrospective effect in order to explain the existing provisions.

If the view of Karnataka High Court is applied into Section 43B read with Explanation 3C, in the present case, as the assessment for the AY 1996-97 is completed much before the insertion of Explanation 3C through the Finance Act, 2006, the question of applying explanation may not arise. However, for the similar facts to the present case, the Supreme Court in the case of Gujarat Cypromet Ltd (supra) has held that Explanation 3C is squarely applicable to the appellant in that case as explanation has retrospective applicability. Which means that even though the assessment is concluded and same is pending at appellate forum, a retrospective amendment being an explanation may come to the rescue for the revenue.

[1] M.M. Aqua Technologies Ltd. v CIT [2021] 129 taxmann.com 145 (SC)

[2] [2005] 143 TAXMAN 43 (DELHI) (MAG.)

[3] [2015] 60 taxmann.com 237 (Delhi)

[4] [2006] 6 SCC 94

[5] [2016] 72 taxmann.com 171 (Delhi)

[6] [1997] 7 SCC 56

[7] (2020) 15 SCC 460

[8] [1981] 4 SCC 173

[9] [2012] 6 SCC 613

[10][10] I.T.A. NO.291 OF 2013