The construction of road is quintessentially a primary infrastructure and boost to the national infrastructure. The construction of road and maintenance thereof, is one of the important factors to boost the national income and economic productivity. The taxation of construction of road under the service tax regime was completely exempted from tax. Though, there was a lot of confusion on the taxation of maintenance of roads under the service tax regime, the ambiguity was put into rest by creating a specific entry for exemption. This was a huge relief to the sector and the service providers, considering the huge stakes of demands.

After the introduction of goods and service tax (for brevity ‘GST’) in India, the construction of roads was brought under tax net attracting rate of tax of 12% with the benefit of input tax credit. The tax on construction of roads under GST regime is to essentially with a view to minimise the number of exemptions to the extent possible, thereby reducing the probability of purchases without taxes in the grey market[1]. Further, the taxation of amounts collected from consumers for accessing the road, which is colloquially referred as toll, is exempted in the service tax and GST regime. Hence, in a normal scenario, where the contract for road is given to service provider with a right to collect toll and there are no other payments from the service receiver except in the form of toll to be paid by the consumers, the services provided by allowing the access to road by paying toll is exempted under the GST regime.

However, with the change in time, the nature of contracts change and as an obvious reason, the taxation would also undergo change. National Highway Authority of India (for brevity ‘NHAI’) is the nodal agency for overseeing the construction of highway roads and incidental activities thereof. One of the models in which the construction of highways/roads is called for tenders is Hybrid Annuity Model, colloquially known as ‘HAM Project’. Under HAM, the construction shall be partly financed by Concessionaire (service provider), who shall recover its investment and costs through payments to be made by NHAI, in accordance with the terms and conditions mentioned in the contract.

The standard contract contains numerous clauses. The ones which are important for the current article are discussed. The scope of the project is normally laid, wherein the Concessionaire is obliged for construction of project as specified in terms of the contract under respective schedules. The Concessionaire is also responsible for operation and maintenance of the project and required to perform and fulfil all other obligations in accordance with the contract.

A concession in form of an exclusive right, license and authority to construct, operate and maintain the project during the construction period of 730 days[2] and operation period of 15 years commencing from commercial operation day is being granted to Concessionaire. A concession granted shall oblige or entitle the Concessionaire to, right of Way, access and license to the site for purposes of and to the extent conferred by provisions of the agreement, finance and construct the project, manage, operate and maintain the project, perform and fulfil all of the Concessionaire’s obligations.

NHAI grants the Concessionaire, commencing from the appointed date, leave and license rights in respect of all land comprising the site which is described, delineated and shown in the respective schedule to the agreement, on an ‘as is where is’ basis, free of any encumbrances, to develop, operate and maintain together with all and singular rights, liberties, privileges, easements and appurtenances whatsoever, for duration of concession period and, for the purposes permitted under the agreement, and for no other purpose whatsoever.

The project shall be deemed to be complete when the completion certificate or the provisional certificate, as the case may be, is issued under the provisions of agreement, and accordingly the commercial operation date (for brevity ‘COD’) of the Project shall be the date on which such completion certificate or provisional certificate is issued. The project shall enter into commercial service on completion date whereupon the Concessionaire shall be entitled to demand and collect Annuity Payments in accordance with provisions of agreement.

The project bid cost is agreed at a price selected in tender and it is agreed that the Bid Project Cost specified is for the payment to the Concessionaire shall be inclusive of cost of construction, interest during construction, working capital, physical contingencies and all other costs, expenses and charges for and in respect of construction of project, save and expect as otherwise provided in the agreement.

The agreement also states that 40% of Bid Project Cost, adjusted for Price Index Multiple, shall be due and payable to Concessionaire in 10 equal instalments of 4% each during construction period. The remaining Bid Project Cost, adjusted for Price Index Multiple, shall be due and payable in 30 bi-annual instalments commencing from 180th day of completion day in accordance with the provisions of the agreement. The Completion cost remaining to be paid, shall be due and payable in bi-annual instalments over a period of 15 years commencing from completion date referred as to ‘Annuity Payments’. The first instalment of Annuity Payments shall be due and payable within 15 days of 180th day of completion date and remaining instalments shall be due and payable within 15 days of completion of each of successive six months referred as ‘Annuity Payment Date’.

Each of the annuity payments due and payable during the years following the COD will be specified. The annuities are split into 30, as stated earlier and a percentage of balance cost is specified against each such annuity. The Concessionaire and NHAI agrees that all operation and maintenance expenses shall be borne by Concessionaire and in lieu thereof, a lump sum financial support in form of bi-annual payments shall be due and payable by NHAI.

Setting the Context:

In simple words, let us assume the cost for construction of road, let us say, is INR 1000 Crore. Out of the INR 1000 Crore, the Concessionaire (service provider) will be paid 40%, that is, INR 400 Crore, over a period of 730 days, in a pre-defined milestone. The balance INR 600 Crores will be paid to Concessionaire (service provider) over a period of 15 years in bi-annual instalments, known as annuities. The Concessionaire (service provider) will be eligible for the said annuity once in 180 days.

The Issue:

The issue for consideration in this article is, the taxability of the above annuity payment. It is clear that the INR 400 Crores, which is received for construction of roads is taxable at 12%. The issue that requires deliberation is the taxability of the INR 600 Crores, the annuity. Let us proceed to deliberate on the same.

The Discussion:

The taxation of annuities was not clear from day one unlike the taxability of construction of roads. As stated earlier, the service by way of access to a road on payment of toll charges is exempted vide Entry 23 of Notification No 12/2017 – CT (R). Though, the annuity is in the nature of toll, paid by NHAI instead of end consumers, the annuity was not covered clearly in the said Entry 23. The matter was taken in 22nd GST Council meeting and the press release note stated at Para 7 as ‘Exemption to annuity paid by NHAI (and State Authorities or State-Owned development corporations for construction of roads) to concessionaires for construction of public roads’. Further, the detailed signed minutes of 22nd GST Council meeting vide Agenda Item 13 (iv) at Para 61 on Page 68 states as under:

- Introducing this Agenda item, the Joint Secretary (TRU-II), CBEC stated that while toll is payment made by users of roads to concessionaires for usage of road, annuity is an amount paid by National Highway Authorities of India (NHAI) to concessionaires for construction of roads in order that the concessionaire did not charge toll for access to a road or a bridge. In other words, annuity is a consideration for the service provided by concessionaires to NHAI. He stated that construction of roads was now subject to tax at the rate of 12% and due to this, there was free flow of input tax credit from EPC (Engineering, Procurement and Construction) contractor to the concessionaires and thereafter to NHAI. He stated that as a result, tax at the rate of 12% leviable on the service of road construction provided by concessionaire to NHAI would be paid partly from the input tax credit available with them. He stated that council may take a view for grant of exemption to annuity paid by NHAI/State Highways Construction Authority to concessionaires during construction of roads. He added that access to a road or bridge on payment of toll was already exempted from tax. The Hon’ble Minister from Haryana suggested to also cover under this provision annuity paid by State – Owned corporations. After discussions, the Council decided to treat annuity at par with toll and to exempt from tax, services by way of access to a road or bridge on payment of annuity’.

As a result, a new Entry 23A, ‘services by way of access to a road or bridge on payment of annuity’ was inserted in Notification No 12/2017 – CT (R) with effective from 13th October 17. Accordingly, the annuities which are in the nature of services by way of access to a road are made tax free. Post this, NHAI has issued a Circular 3.3.17 dated 23.10.2017 by making reference to the above newly inserted Entry 23A, stated that there will be no GST payments on annuities. The above position was accepted by the GST Council, the NHAI and the Concessionaire (service provider). The service provider in light of the exemption granted to 60% of the bid project cost, also reversed the credits pertaining such exempted supplies in light of Section 17(2) of Central Goods and Services Tax Act, 2017.

Years passed by and to the utter shock of everyone, post 43rd GST Council meeting, which was held on 28th May 2021, a circular vide 150/06/2021 – GST dated 17th June 2021 has been issued clarifying as under:

2.2 Services by way of construction of road fall under heading 9954. This heading inter alia covers general construction services of highways, streets, roads railways, airfield runways, bridges and tunnels. Consideration for construction of road service may be paid partially upfront and partially in deferred annual payments (and may be called annuities). Said entry 23A does not apply to services falling under heading 9954 (it specifically covers heading 9967 only). Therefore, plain reading of entry 23A makes it clear that it does not cover construction of road services (falling under heading 9954), even if deferred payment is made by way of instalments (annuities).

The above circular has reversed the position that the annuities which were received over a period of time were exempted. In our view, since the annuities are paid in lieu of toll, we believe that the exemption under Entry 23A shall be applicable. Further, a circular cannot lay down a proposition which is contrary to the notification and the circular should give way to notification to prevail. However, post issuance of the above circular, despite of the fact, it is not capturing the true intention of the notification, it is difficult to take a stand that the said annuities are exempted considering the stakes involved. Hence, NHAI has to make a representation to GST Council to bring more clarity on the said exemption. When the NHAI and service provider are very much aware of the business model and the nature of annuities, the Circular 150/06/2021 putting the clock back and stating that exemption is not available is clearly uncalled for. The desperate tax authorities, taking clue from the above circular would come on to the service providers demanding tax on the annuities.

Assuming for a minute that the annuity is taxable, there are so many other questions which requires consideration. Some of them are as under:

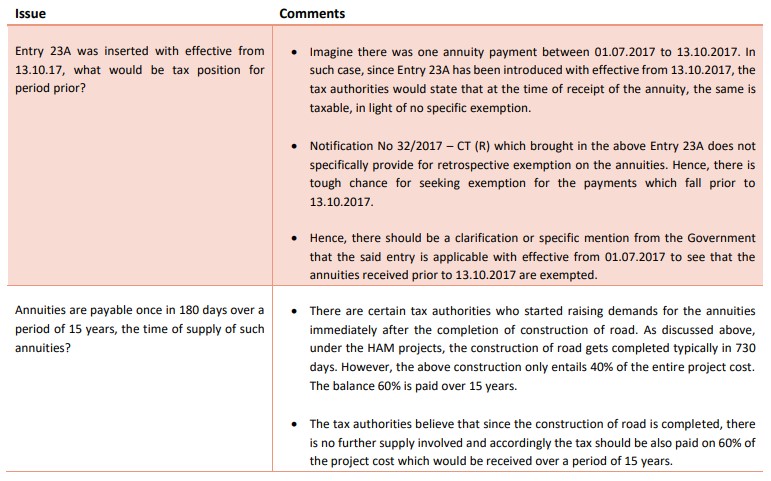

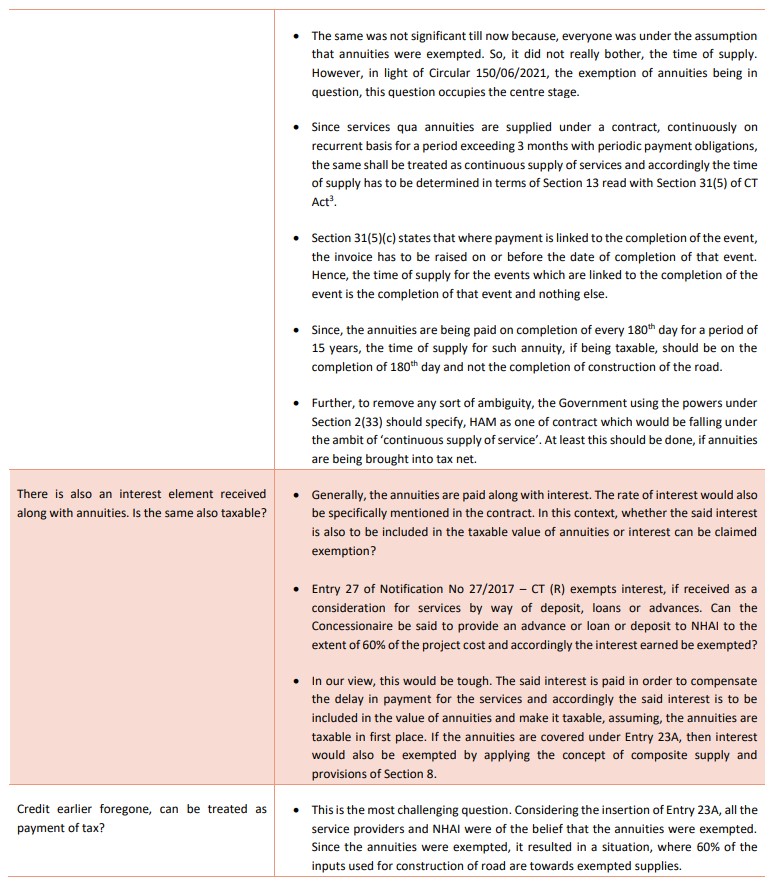

- Entry 23A was inserted with effective from 13.10.17, what would be tax position for period prior?

- Annuities are payable once in 180 days over a period of 15 years, the time of supply of such annuities?

- There is also an interest element received along with annuities. Is the same also taxable?

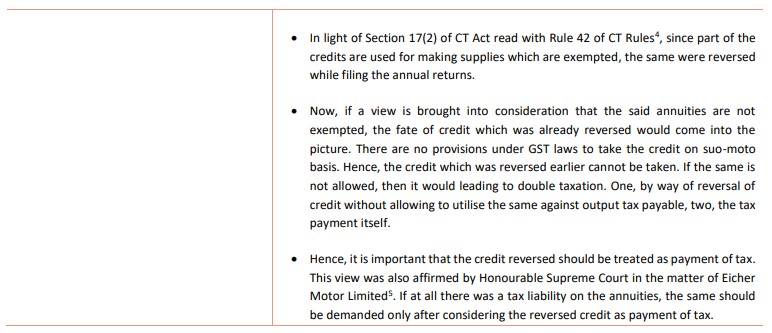

- Credit earlier foregone, can be treated as payment of tax?

Let us take each one of the above and detail the implications:

[1] exemption on output always comes with condition of non-availment of credit which would encourage service provider to buy goods where there is no burden of input tax

[2] may vary from contract to contract.

[3] Central Goods and Services Tax Act, 2017

[4] Central Goods and Service Tax Rules, 2017

[5] (1999) 2 Supreme Court Cases 361