Introduction

Issue of notice under Section 148 of Income Tax Act, 1961 (for brevity ‘ITA’) after 31.03.2021 under old provisions has created lot of litigation at various High Courts and currently, the Supreme Court has reserved its judgment on such controversy. For detailed analysis of issue of notice under section 148, read our article here[1].

As the above controversy is settling down, a new issue has been come up for discussion at various High Courts. Earlier, assessments under section 143(3) or reassessments under section 147 are used to be completed in physical mode. However, after the introduction of Faceless Assessment Scheme (for brevity ‘FAS’), the concept of assessment procedure has been changed totally to digital mode. For details of faceless assessment scheme, we recommend reading our Article on FAS here[2].

Section 149 (old provisions as well as amended provisions) states that notice under section 148 shall not be ‘issued’ after the expiry of time limit specified in section 149 for making the reassessment under section 147.

After the introduction of FAS, as stated earlier, assessments are being completed done digitally wherein issue of notice and submission of reply to such notice are to be performed digitally.

As such notices are to be issued digitally, the question that arose was, what is the date of issue of notice, whether it is signing of notice by using digital signature certificate or sending of such notice through email?

Issue of Notice:

The term ‘issue’ has not been specifically defined under ITA. The Black's Law Dictionary defines the term ‘issue’ to mean ‘To send forth; to emit; to promulgate; as, an officer issues orders, process issues from court. To put into circulation; as, the treasury issues notes. To send out, to send out officially; to deliver, for use, or authoritatively; to go forth as authoritative or binding. When used with reference to writs, process, and the like, the term is ordinarily construed as importing delivery to the proper person, or to the proper officer for service etc.’

To be precise, sending from the origin may be considered as ‘issue’ for the purposes of the Act.

Further, section 282A states that where any notice or document to be issued by any income tax authority, such notice or document shall be signed and issued in paper form or communicated in electronic form, to mean that signing of notice may not be considered as issue of notice.

The Hon’ble Gujarat High Court in the case of Kanubhai M. Patel (HUF)[3] has held that mere signing of notice cannot be equated with issuing of notice and the date on which the same were handed over for service to the proper officer would be considered as date of issue. When the notice is issued in paper form, the date on which the said notices were actually handed over to the post office for the purpose of booking for the purpose of effecting service on the petitioners has to be considered as date of issue.

The issue of notice in paper form is covered by the above judgment. However, after the introduction of FAS, income tax authority is issuing notices in digital form.

When the notice is issued in digital form, how to determine date of issue of notice? High Courts have interpreted the term issue of notice in digital form in recent times, which is detailed hereunder.

In the matter of Daujee - Allahabad High Court:

The Hon’ble Gujarat High Court in the case of Daujee Abhushan Bhandar Pvt. Ltd[4] (for brevity ‘Daujee’) has analyzed the various provisions of Income Tax Act and Information Technology Act and delivered its judgment.

- The words “issue” or “issuance of notice” have not been defined under the Act. However, the point of time of issuance of notice may be gathered from the provisions of the Act and the Rules and the Information Technology Act, 2000.

- Section 282A provides for authentication of notices and other documents by signing it. Sub- Section 1 of Section 282A uses the word “signed” and “issued in paper form” or “communicated in electronic form by that authority in accordance with such procedure as may be prescribed”. Thus, signing of notice and issuance or communication thereof have been recognised as different acts.

- The communication in electronic form has been prescribed in Rule 127A of the Rules 1962 which provides a procedure for issuance of every notice or other document and the e-mail in electronic mail which has to be issued from the designated e-mail address of such income tax authority.

- Rule 127A (1) of the Income Tax Rules states that every notice/document communicated in electronic form by any income tax authority shall be deemed to be authenticated in case of email, if the name and office of such income tax authority is printed on the email body and is issued from the designated e-mail address of such income tax authority.

- Thus, mere signing of notice using digital signature (for brevity ‘DSC’) cannot be considered as issuance of notice. After signing the notice by using the DSC, income tax authority has to issue such notice to the assessee either in paper form or through email.

- Section 13 of Information Technology Act states that the dispatch of an electronic record occurs when it enters a computer resource outside the control of the originator’.

- Which means that issue of notice through electronic record completes only when such document enters a computer resource outside the control of the originator.

- Therefore, after a notice is digitally signed and when it is entered by the income tax authority in computer resource outside his control i.e., the control of the originator then that point of time would be the time of issuance of notice.

Considering the above analysis, the High Court has held that firstly notice shall be signed by the income tax authority and then it has to be issued either in paper form or be communicated in electronic form by delivering or transmitting the copy thereof to the person therein named by modes provided in the act which includes transmitting in the form of electronic record.

Accordingly, the Court has held that the point of time when a digitally signed notice in the form of electronic record is entered in computer resources outside the control of the originator i.e., the assessing authority that shall be the date and time of issuance of notice under section 148 read with Section 149 of ITA.

In the matter of Malavika Enterprises - Madras High Court:

The Hon’ble Madras High Court in the case of Malavika Enterprises[5] has distinguished the decision of Daujee by Allahabad High Court (supra). Madras High Court as well referred the same provisions of the ITA but interpreted them in different way:

- Section 282(1) of the Act provides that service of notice or summon or requisition may be made by delivering or transmitting a copy thereof to the person therein named.

- Section 282A states that notice/document shall be signed and issued in paper form or electronic form.

- Rule 127A states that every notice or other document communicated in electronic form by an income tax authority under the Act shall be deemed to be authenticated in case of electronic mail/electronic mail message, if the name and office of such income-tax authority is printed on the email body and if the notice or other document is in the email body itself.

- A perusal of the notice dated 31.3.2021 shows it to have been sent through email and as per Rule 127A(1), it is deemed to be authenticated if the name and office of the income tax authority is printed on the email body or is printed on the attachment to the email.

- The petitioner could not bring any fact on record to show that notice under Section 148 of the Act of 1961 was not issued by the electronic mode, i.e., by email, on 31.3.2021 and, that too, when the fact regarding digital signature of the authority could not be disputed.

- While discussing the issue, the Division Bench of the Allahabad High Court has referred to Rule 127A, which deals with communication in the electronic form and after referring to Section 13 of the Information Technology Act, 2000, it was held that despatch of an electronic record occurs when it enters a computer resource outside the control of the originator.

- Accordingly, the Allahabad High Court has held that if a notice is digitally signed by the income tax authority and it is entered by the income tax authority in computer resource outside the control, then that point of time would be the time of issuance of the notice.

- Conclusions finally drawn by the Allahabad High Court on the facts of that case cannot be applied, rather we cannot change the language of the provision by changing the word "issuance" to that of "receipt".

Accordingly, Madras High Court has dismissed the writ petition filed by the appellant stating that as the notice has been signed by using DSC on 31.03.2021 and same has been issued on 31.03.2021, date of receipt of email cannot be considered as date of issue of notice.

Our Comments:

After analysing the above two judgments, it can be found that both the High Courts have referred the provisions of section 282A read with section 127A for the purpose of interpretation of ‘issue of notice’. However, the outcome of the judgement differs each other.

Two High Courts have expressed two different views in respect of issue of notice through email. Allahabad High Court has held that mere signing of notice cannot be equated with issue of notice and date of sending email has to be taken into account for determining the date of issue of notice.

However, Madras High Court has held that as the appellant has not brought anything on record to substantiate that the notice has been issued after 01.04.2021, as the notice is generated digitally by using the DSC on 31.03.2021, such date of signing has to be considered as date of issue of notice for the purpose of section 149.

However, the fact of sending mail on 31.03.2021 is not specifically mentioned in the order which leaves some doubts regarding the date of sending email.

The appellant has argued that as the mail was received on 01.04.2021, such mail would have sent on 01.04.2021. When the email has been sent, it will be presumed to be delivered instantly to the receipt, unless there are any technical glitches.

However, High Court without discussing above aspect, taken different direction that date of receipt of cannot be equated with date of issue of notice.

Further, when the notice is issued by the income tax authority, it has to substantiate that the notice has been issued on such date. However, the Madras High Court has shifted the burden of proof to the appellant and as the appellant could not substantiate the date of sending email by the income tax authority, the High Court has held that date of signing of notice by DSC has to be considered as date of issue.

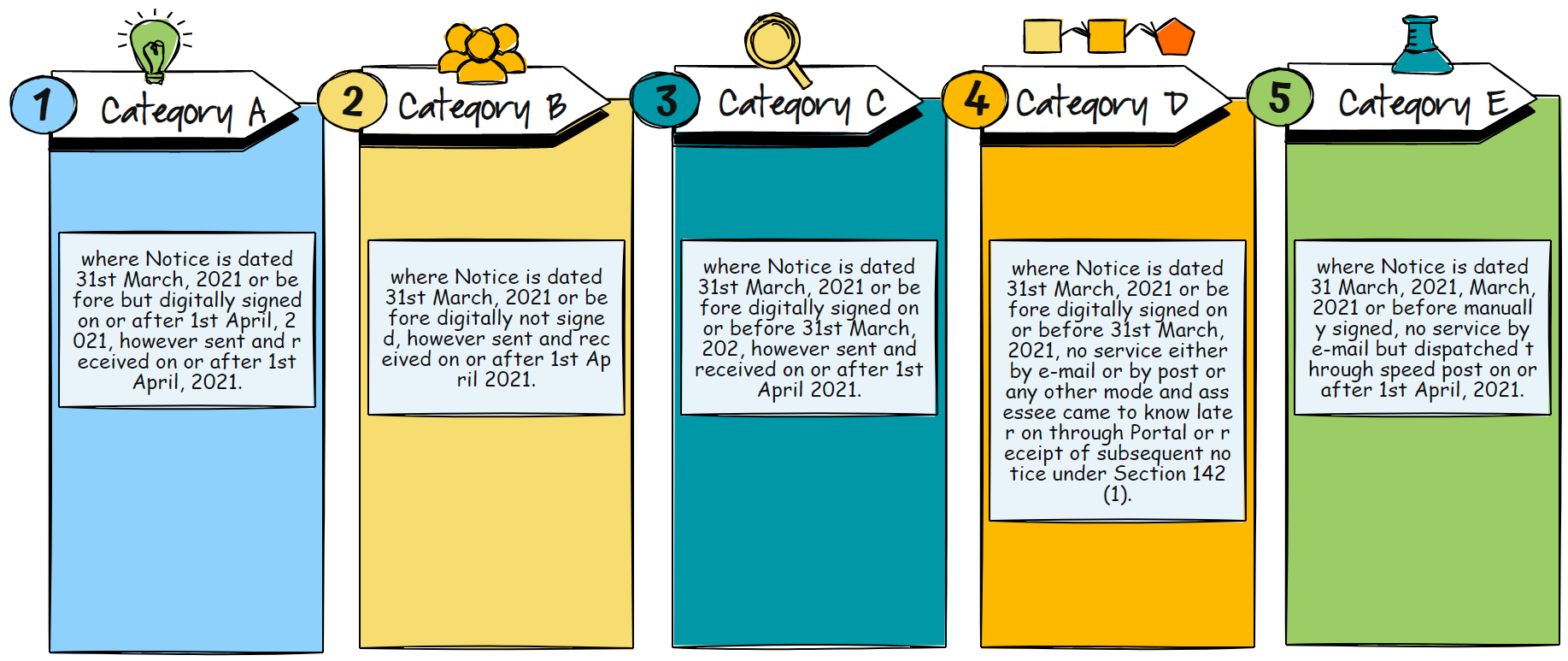

Further, one more writ has been field before the Hon’ble Delhi High Court[6] wherein the High Court has framed the following question of laws:

- Category A: Is in respect of writ petitions where Notice is dated 31st March 2021 or before, but digitally signed on or after 1st April, 2021, however sent and received on or after 1st April, 2021.

- Category B: is in respect of writ petitions where Notice is dated 31st March 2021 or before, digitally not signed, however sent and received on or after 1st April 2021.

- Category C: is in respect of writ petitions where Notice is dated 31st March 2021 or before, digitally signed on or before 31st March 2021, however sent and received on or after 1st April 2021.

- Category D: is in respect of writ petitions where Notice is dated 31st March 2021 or before, digitally signed on or before 31st March, 2021, no service either by e-mail or by post or any other mode and assessee came to know later on through Portal or receipt of subsequent notice under Section 142(1).

- Category E: is in respect of writ petitions where Notice is dated 31st March 2021 or before, manually signed, no service by e-mail but dispatched through speed post on or after 1st April 2021.

As two High Courts has not gone into depth the issue, the decision of Delhi High Court is much waited for better understanding the ‘issue of notice’ digitally.

[1] SBS-I-19th-Edition.pdf (sbsandco.com)

[3] [2011] 12 taxmann.com 198 (Gujarat)

[4] WRIT TAX No. - 78 of 2022

[5][TS-288-HC-2022(MAD)]

[6] W.P.(C) 4777/2022`