The recent Delhi Tribunal judgment in the matter of Young Indian[1] is the second in the series for Young Indian (for brevity ‘YI’). The first was the cancellation of registration under Section 12AA of Income Tax Act, 1961 (for brevity ‘ITA’). The article on that particular judgment is available at here. In this article, we deal with the recent judgment wherein the tax was levied on YI in terms of Section 28(iv) of ITA.

The judgment of tribunal is contained in 571 pages, wherein YI has challenged the Commissioner of Income Tax (Appeal)’s order on 16 counts. In this article, we are only dealing with the taxation of the income in the hands of YI and its corresponding valuation issues. We recommend the readers to read the entire judgment for a holistic understanding of the matter. The facts that are relevant to the current issue dealt in the article are narrated hereunder for the benefit of the reader.

YI was incorporated as a company under Section 25 of Companies Act, 1956. Memorandum of Association was subscribed by two directors, namely Mr Suman Dubey and Mr Satyam Gangaram Pitroda with 550 equity shares each. Post incorporation, both the shareholders transferred their shares to Mr Oscar Fernandes and Mrs Sonia Gandhi (SG). Subsequent to such transfer, Mr Suman Dubey and Mr Satyam Gangaram Pitroda were appointed as directors of a company, M/s Associated Journals Limited (AJL). Later, Mr Rahul Gandhi (RG) was appointed as director of YI and also acquired 3600 shares of YI. Simultaneously, SG has further acquired shares totalling to 3600 shares of YI and also become a director of YI.

As on 31.03.2010, AJL owes an amount of Rs 88.86 Crores to All India Congress Committee (AICC). AJL has further taken a loan from AICC totalling the outstanding to Rs 90 Crores. The share capital of AJL was Rs 1 Crore. AICC has transferred the outstanding loan of Rs 90 Crores from AJL for a consideration of Rs 50 lakhs to YI. Later, the share capital of AJL was increased to Rs 10 Crores and the additional shares were allotted to YI (99.99%) giving the maximum control of AJL to YI. The balance shares were subscribed by SG, RG and Mrs Priyanka Gandhi (PG).

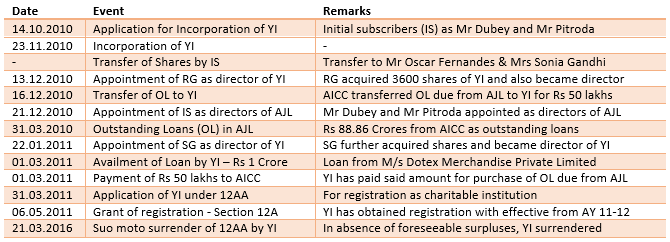

The dates of the events detailed in this article is tabulated as under for easy comprehension:

From the above table, it is evident that YI has acquired loan from AICC. In consequence to the loan purchase, AJL has allotted equity shares to YI, thereby AJL becoming subsidiary to the YI.

Contentions of Assessing Officer – During Reassessment:

The Assessing Officer (for brevity ‘AO’) contended that from the narration available in the annual report of AJL for 2010, it is evident that the loan of Rs 90.21 Crores from AICC was not disclosed in the annual report of the AJL, because as per the report, loan only included advances, loan and security deposits for construction activities from parties and from others, not from AICC. The AO has issued notices under Section 133(6) of ITA to AICC on different dates to inquire about evidence relating to time, mode, manner of advancing loans and nature of fund out of which these loans were advances. However, no clarification or evidence was submitted by AICC to substantiate the grant of loan to AJL. The AO further stated that the amount of unsecured loan of Rs 90.21 Crores does not tally with the amounts shown as per balance sheet of AJL and another important issue is the quantum of loan of Rs 90.21 Crore which was coincidentally just sufficient for allotment of 9.021 Crore shares of AJL to YI which accounted for 99% of share capital of AJL allowing takeover of AJL by YI.

The AO also pointed out that all the rights over the above alleged loan were sold by AICC to a newly incorporated entity, YI, within 23 days after incorporation at a paltry sum of Rs 50 lakhs. The AO also stated that at the time of assignment of loan, YI did not have any money to make payment of Rs 50 lakhs and it could allegedly arranged the money to make payment of Rs 50 lakhs only in February 2011, which is after two and half months from the date of assignment of alleged loan to YI by taking a loan from Dotex Merchandise Private Limited (for brevity ‘Dotex’) to the tune of Rs 1 Crore. It was further stated by AO that Investigation Wing reported that AICC assigned the loan of Rs 90.21 Crores to YI for a paltry sum of Rs 50 lakhs, for the reason that AICC was not sure if AJL would be in a position to return the loan. The AO stated that since AJL and AICC has common people, it would not be correct to state that AJL is not in a position to repay the loan considering the huge properties that it has as its assets. Further, the AO stated that the takeover of AJL by YI happened prior to the payment made by YI to AICC for acquisition of loan, which would show that the entire chain of events were only done to acquire the AJL. Further, the loan taken from Dotex was not paid back by YI and that too the loan is free of interest. AO stated that the directors of Dotex are also directors of other 50 companies based out in Kolkata, which are engaged in accommodation entries. Since no interest is paid or loan is repaid, the genuineness of loan taken by YI from Dotex is also doubtful.

The AO stated that the sequence of transactions carried on by entities (AJL, AICC, YI and Dotex) are not as per normal commercial practices. The AO stated that the AICC claimed selling loan of Rs 90.21 Crores to YI in the month of December 2010 even when assignment of loan was not acknowledged and confirmed by the AJL but YI paid sale consideration to the AICC only in the month of March 2011 at the time when the AJL was already taken over YI by allotment of 99% of paid up share capital of AJL. The end results of this transactions were was takeover of AJL a real estate company having properties of several hundred crores by YI by meagre investment of Rs 50 lakhs. The AO stated that such takeover of real estate company having assets worth of more than Rs 1600 Crore the value which was taken cognizance by Metropolitan Court of Delhi at price of Rs 50 lakhs is unheard of. The takeover of AJL by YI has resulted actually in acquisition of all the immovable properties of AJL along with right to enjoy huge rental income of several crore from some of the properties. YI has not disclosed that it has purchased the loan from AICC in its P&L account for FY 2010-11 and also has not shown the investment in shares of AJL in its balance sheet, stating that the value of investment is negative.

The AO stated that since investment of Rs 50 lakhs was made with a profit motive, the above transaction was adventure in nature of trade under Section 2(13) of ITA and value of above referred properties of AJL was a benefit which represents profits and gains to YI under Section 28(iv) for FY 2010-11 and accordingly demanded tax on the amount of Rs 413.41 Crores. The AO placed reliance on the judgments of Supreme Court and High Courts to state that the activity undertaken by YI is in the nature of trade and the benefits (benefit of underlying shares of AJL, benefit of right to enjoy the business assets of AJL, benefit of income from real estate business of AJL and benefit of rental income of several crores from letting out of business assets of AJL) arising thereof should be subjected to tax in the hands of YI in terms of Section 28(iv).

Contentions of YI:

The main contention of YI before the Tribunal has been that YI has acquired the shares of AJL with the intention to use it as launch pad for its objectives. YI claimed that their objects are similar to the objects of AJL and hence the acquisition of AJL has happened to achieve their common objectives. YI placed reliance on the judgment of Indian Medical Trust (2009) 414 ITR 296, wherein the High Court held that acquisition of shares in furtherance of its objects, then the same is regarded as genuine activities.

YI contended that the allegations of AO are without any proof and only a figment of his imagination. YI contended that even if it is assumed that the loan was a bogus entry with the intention to acquire 99% of AJL, it defies any logic why an odd figure of Rs 90.21 Crores was made up. YI stated that the loan advanced by AICC to AJL was genuine, because it was a subject matter of a petition before Election Commission in 2012, where some political rival has approached the Election Commission to de-recognize AICC in terms of Election Symbols (Reservation and Allotment Order) 1968 on the ground that party loaned more than Rs 90 Crores to AJL in violation of guidelines and rules for registration as well as recognition of political parties. The Election Commission dismissed the petition stated that under Section 29B/C of Representation of People Act, 1951, they have power to monitor as to how political parties raise funds but not how they spend. YI uses this to defend to prove the genuineness of loan advanced by AICC to AJL. YI in order to refute the allegations of AO has submitted the ledgers of both AJL and AICC from FY 2002-03 to demonstrate the genuineness of loan.

YI contended that the logic as to why the loan of AJL was assigned by AICC to YI is that latter is incorporated with objects of inculcating in the mind of India’s youth, commitment to the ideal of democratic and secular society and since AICC endorses and supports the above objects of YI, which AICC has advocated. Hence, to support these objects and also keeping in the mind that AJL is not in a position to repay the loan, AICC has agreed to assign the loan for Rs 50 lakhs. YI also refuted the submissions of AO, wherein it was alleged that YI does not have amount to purchase the loan, by stating that the loan was raised from Dotex in December 2010 only because there is a delay in opening of bank account, the amount could not be paid. YI contended that AJL was stated to be a real estate business after closure of the publication business in the assessment order at various places and the same was not true because the publication business was never closed. AJL was temporarily suspended but not closed and it contended that it was never engaged in trade of its real estate properties. YI supported that it was very normal in the newspaper business to rent out the unused properties and just because AJL has rented certain properties, the same cannot be treated as real estate agency. YJ contended that that there was a full disclosure of the transactions with AJL, in the financial statements of YI vide the notes to accounts. YI contended that it is not necessary to immediately pay the consideration of Rs 50 lakhs to AICC on the date of assignment of loan itself and it is normal practice to allow credit period for payment of dues and that by itself has no relevance to decide the genuineness of transaction. YI contended that though its registration under Section 12A stands cancelled, it is undisputed that the YI was and continues to a charitable organisation and all the restrictions applicable to a charitable company is applicable to it. If seen in this light, it would be realised that all the allegations made by AO about common office bearers, ultimate benefit, etc obtained by promoters of the YI has no relevance at all, since at the end of the day, any income of YI can be used for no other purpose except for its objects and it cannot be diverted for the benefit of any other person or for any ulterior purpose in any manner whatsoever. YI contended under no circumstance the alleged benefit of assets of AJL can percolate to any members of the YI and AO has not even made any attempt to show that any personal benefit is being taken by YI or its members and accordingly stated that order has to be set aside. YI further stated that it is trite law that by acquiring the shares of a company, shareholder does not become the owner of the assets of company and placed reliance on the decision of Mrs Bacha F Guzdar 27 ITR 1 and many others. YI contended that since they are not engaged in business, there cannot be any tax under Section 28(iv).

Ruling by Tribunal:

The Tribunal stated that during the proceedings of cancellation of registration under Section 12AA before the same Tribunal, it was clearly held that at no point of time, YI has carried out any charitable activities in furtherance of its objects and to promote its objects. The Tribunal stated that if the intention of YI was to promote its so-called charitable objects, then why not its objects were pursued through other agencies and why from an entity (AJL) which was no longer into publication and ceased its business in 2008. This is the reason for which the Tribunal has categorically held that right from the day of its inception to grant of registration under Section 12AA until the cancellation of registration by Learned CIT (Exemption), such purported objects were never pursued. The Tribunal stated that the entire contention as raised by YI that the newspaper business was started later on, which indicates that AJL was acquired only to promote the ideals enshrined in the objects of YI, belies all such intents. The Tribunal further stated that a very important fact in the entire chain of events and on the issue, is the judgment of Delhi High Court in case of AJL against the notice sent by Land Development Office for vacation of the property, wherein the High Court noted that at the time of inspection by the Land Development Office, no press activity was carried out by the AJL in the said property and in fact, the property was rented out to various commercial establishments. When the said order of single judge was challenged before the Division Bench of Delhi High Court, the Divisional Bench after considering the entire material has upheld the judgment passed by Single Judge. The Divisional Bench rejected the reliance on the judgment of Bacha F Guzdar (supra) relied by AJL by stating that it is equally settled principle of law that in public interest and for assessing the actual nature of transaction or the modus operandi employed in carrying out a particular transaction, the theory of lifting of corporate veil is permissible and a court can always apply this doctrine to see as to what is the actual nature of transaction that has taken place, its purpose and then determine the question before it after evaluating the transaction or modus operandi employed in the backdrop of public interest. Referring to various Supreme Court decisions on lifting of the corporate veil, the Divisional Bench stated that in the present case with regard to how the transfer of shares between AJL and YI took place, the take-over of right to recover a loan more than Rs 90 Crores from AICC for a consideration of Rs 50 lakhs, thereafter replaced the original shareholders of YI by four new entities and YI after acquiring 99% of shares in AJL, became the main shareholder with four of its shareholders acquiring the administrative right to administer property of more than Rs 400 Crores, it is a fit case to lift the veil. The Divisional Bench held that this was a classic case of clandestine and surreptitious transfer of lucrative interest in the premises to YI.

The Tribunal stated that if they test the arguments of YI in line with the judgments of Delhi High Court in the case of AJL and Tribunal in YI’s case, the entire contention that these transactions were nothing but to promote the objects of YI has to be rejected. The Tribunal stated that on piercing of the corporate veil, it is evident that YI has acquired the underlying assets which are huge properties of AJL and to get commercial benefit derived from such properties. The Tribunal held that, it is not necessary to examine whether the benefit of acquisition of properties would have come in the form of dividend to shareholders or not is irrelevant, because what is relevant is the real intention behind the entire scheme of acquiring AJL. The Tribunal stated that if one sees from the angle of third-party scenario, whether in case of some third-party comparable instance and amongst unrelated entities, can such transaction between the parties will happen where, one party assigns the loan of more than Rs 90 Crores for a paltry sum of Rs 50 lakhs to other, and for the same paltry amount, the entire shareholding of a company who owed the debt of Rs 90 Crores is transferred to a newly formed company who is not into same or any kind of business, along with all the underlying assets of that company which is being taken over and the worth of those assets are running into hundreds of crores and that to be of a company which has suspended all the publication activities and the company whose shares are being acquired were no longer into business of publication. It was held that the chain of events leads to only one conclusion that it is nothing but a masquerade and make-believe arrangement which has been given cloak of charity and to believe that it was purely for purpose of charitable activities.

The Tribunal rejected the contention taken by YI that there cannot be any tax under Section 28(iv), since YI was not into business and only a charitable organization by stating that once the corporate veil was lifted and interested parties have been found in collusion with each other to give huge benefits of hundreds of crores of property to YI, the only inference which can be drawn is that all which has been tried to showcase the picture was phantasmagorical illusion and not real. The Tribunal held that the word ‘benefit’ occurring in Section 28(iv) means some kind of adventure or gain or had same value or acquire any interest in land, chattel etc and thus the benefit is nothing but any form of adventure and here the adventure is clearly getting the underlying huge properties situated all over the country by stroke of one transaction and to enjoy all those properties in future. The Tribunal rejected the contention of YI that it is a case of acquisition of shares simplicitor at a lower rate and hence cannot be brought under Section 28(iv) by stating that the above stand demolishes when seen in the entire scheme of things. The next contention that YI had that the benefit arising out of acquisition of shares was in capital field and cannot be brought to tax under Section 28(iv) was rejected by Tribunal by stating that the instant is not a case of acquisition of shares per se, albeit it is a case where YI had acquired the benefit in the interest in the immovable properties held by AJL and acquisition of shares is a merely a step in entire adventure.

The Tribunal held on valuation of properties stating that the benefit to YI was underlying value of these shares by way of right to enjoy all the benefits embodied in the commercial assets held by AJL at several locations in the country. AO has held that the value of benefit is represented by Fair Market Value (for brevity ‘FMV’) of the business properties, exploitation whereof would yield benefit of such assets as exist on the date of taking over of AJL by YI. Further, YI stated that since there was no separate methodology given under Section 28(iv) for valuation of benefit, the valuation methodology prescribed under Rule 11UA of Income Tax Rules, 1962 (for brevity ‘IT Rules’) has to be adopted and accordingly furnished a valuation report of shares of AJL prior to conversion, which was arrived at negative figure of Rs 770.09. The Tribunal rejected the said contention by stating that acquisition of shares is only a step in the entire transaction and hence the value of shares cannot be adopted. Post that, Tribunal has taken up the valuation reports issued by District Valuation Officer for each property and decided on the value of the properties and held that the same would be the value of the benefit derived by YI in terms of Section 28(iv).

Concluding Remarks:

When the entire scheme of things are seen together, what appears to be is simple strategy for taking over the assets of AJL by YI. The documentation was not water tight, the procedures was not followed, there was no commercial substance at all. It is unimaginable that a loan of value of Rs 90 Crore was assigned to YI for Rs 50 lakhs. If there is another company in place of YI, will AICC do the same thing? Further, why is AICC is bothered about Rs 50 lakhs when the loan amount of Rs 90 Crores was vanished. What would they do with a paltry sum of Rs 50 lakhs? It is clear that the entire scheme is to obtain the assets of AJL at a throw away price and to create a legal and technical link, YI has purchased the loan from AICC to see that eventually they acquire AJL. At any point in the chain of events, there was a commercial substance and if this happened in GAAR era, the tax authorities would not have strained themselves so much to bring the amount to tax under Section 28(iv). Undoubtedly, YI would approach High Court against this order and it has to be seen what further stands would YI take before the High Court since the later knows the entire story and believes what Tribunal stated is right. An interesting times for us and tough times for YI, we have to wait and watch.

[1] TS-234-ITAT-2022 – Del